In this extract from November’s Preqin Hedge Fund Spotlight, Alastair Hannah takes a detailed look at CTA launches, different trading methodologies, strategies and markets traded, as well as providing an outlook for the rest of the year.

CTA launches

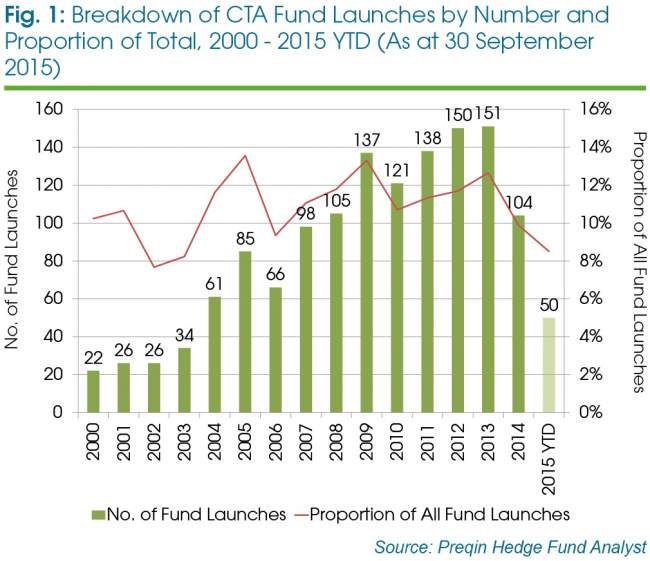

Fifty CTAs have launched in the first nine months of 2015 to 30 September (Fig 1). Although the number of funds launched this year is likely to grow as managers bring new funds to market in the final quarter, and also due to more data becoming available, 2015 looks set for the fewest CTA launches since 2006. Similarly, the proportion of CTAs launched, as a fraction of all hedge fund products incepted each year, has decreased to its lowest level since 2006, at 9 per cent as at 30 September 2015.

At the start of 2015, Preqin noted that demand for CTAs from investors would be relatively small in the year ahead. Our H1 2015 Investor Outlook, based on interviews with over 300 investors, showed that just 14 per cent of CTA investors planned to increase their allocations over 2015, with 10 per cent planning to decrease their exposure. However, CTAs witnessed modest inflows of USD6.4 billion during H1 2015 with 45 per cent of existing CTAs showing net inflows in Q2, a greater proportion than hedge funds (41 per cent). Despite this, concerns over the performance of the sector remain. Preqin’s mid-year investor surveys showed that 80 per cent of investors were dissatisfied with systematic CTA performance over the first half of the year, while 73 per cent were dissatisfied with discretionary CTA performance.

As a result, CTAs are operating in a challenging environment with a fall in commodity prices, poor performance and declining investor sentiment. The decline in new fund launches may be a result of fund managers focusing on existing products before taking new funds into the currently troublesome market.

Trading methodologies, CTA strategies and markets traded

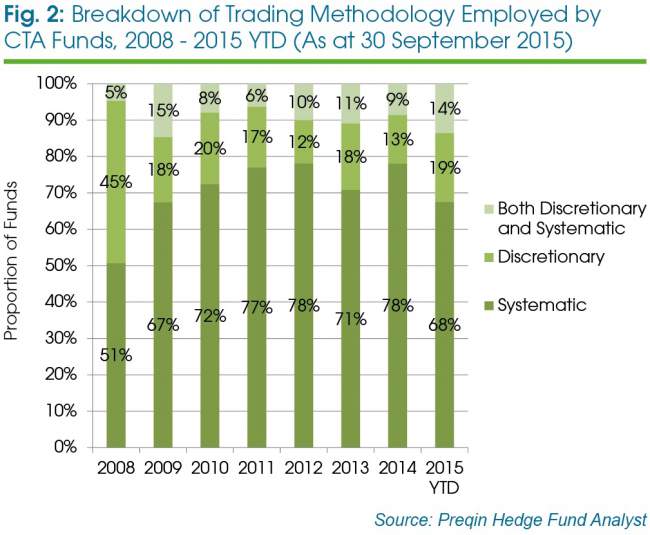

Systematic-only strategies dominate the CTA industry; however, the proportion employing a systematic methodology has fallen over the last year (Fig 2). From 2008 to 2012, systematic strategies accounted for an increasing proportion of funds’ trading methodologies, from 51 per cent to 78 per cent respectively. A sustained bull market and a reduction in volatility in global markets since 2009 has sometimes challenged the effectiveness of the systematic trading method, which relies heavily on large price movements and wide bid/ask spreads on securities. So far, 2015 has witnessed a reduction in the number of CTAs utilising pure systematic strategies and growth in the amount using either a mixture of discretionary and systematic strategies, or a pure discretionary approach (Fig 2). As at September 2015, 14 per cent of new CTA launches this year employ a combination of both discretionary and systematic trading strategies – the largest proportion of funds using both strategies since 2009 – as portfolio managers in the sector seek enhanced flexibility.

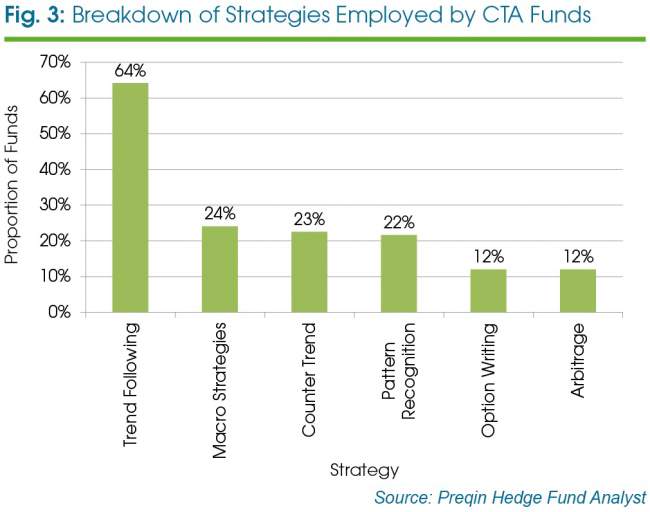

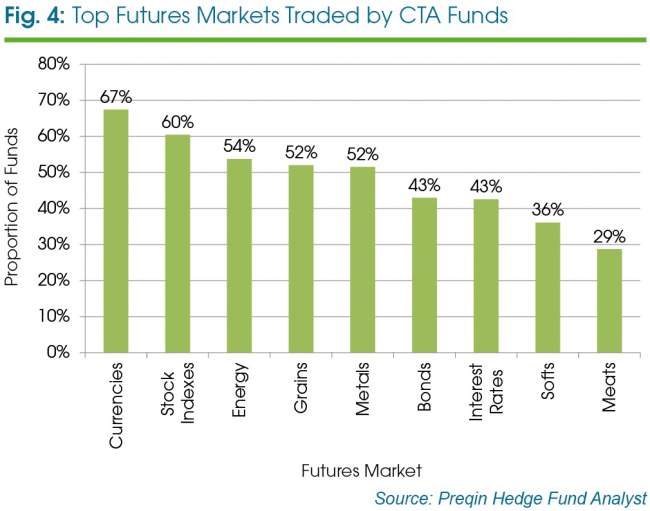

Fig 3 shows that the majority of CTAs (64 per cent) use a trend-following strategy. With commodity prices suppressed, CTAs can still use a wide range of other assets, offering diversification and an effective hedge for investors within a portfolio otherwise strongly correlated to traditional markets. Currency markets remain the dominant area of focus for the majority (67 per cent) of CTAs (Fig 4), with stock indexes the second most common market traded by CTAs.

Outlook

CTAs exist as a true alternative to traditional products, offering an effective hedge against difficult economic environments and market downturns. The poor performance of the sector in the years of the bull market has hit investor confidence in the asset class, and it has become increasingly difficult for CTAs to raise capital. In 2015, we have seen relatively few new launches in the managed futures sector, as fund managers focus on existing products or other strategies. The current market environment, however, may re-establish the value of CTAs as a non-correlated asset within diversified portfolios, to add some downside protection for investors. In turn, we may see renewed launch activity in this space.

This is an extract from Preqin Hedge Fund Spotlight: November 2015, which also looks at CTA performance in 2015 and institutional investor activity in CTAs.

Read the full Spotlight newsletter here.