With some of the biggest names in private equity real estate raising ever larger funds, this extract from Preqin Real Estate Spotlight looks at how emerging managers are faring in the fundraising market and how investor appetite for new firms is changing.

The fundraising environment for emerging managers* seems especially daunting in recent times amid intense competition for fundraising; managers lacking an established track record are finding it difficult to gain traction and secure institutional investor commitments. Larger, more experienced real estate firms, however, have been securing ever greater proportions of fundraising, but has this been at the expense of newer entrants to the marketplace?

Emerging manager fundraising

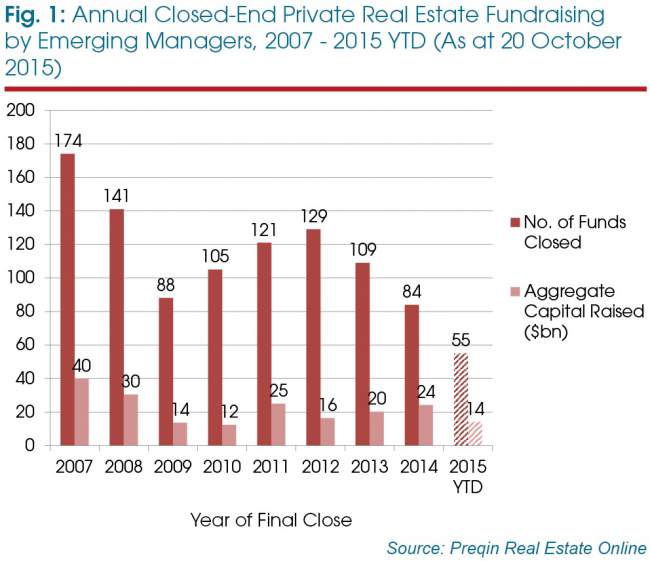

Fundraising by emerging private real estate managers has struggled to emulate its pre-crisis peak of 174 funds reaching a final close for USD40 billion in capital commitments (Fig 1). The downturn led to year-on-year declines in aggregate capital raised before recovering in 2011, when a post-crisis peak of USD25 billion was raised from 121 funds. Interestingly, despite 35 per cent fewer funds reaching a final close in 2014 than in 2012, there has been a 50 per cent rise in capital raised. As it stands, a similar amount of capital to the five-year average should be raised by emerging managers in 2015. However, there are 211 private real estate funds in market that are managed by emerging firms seeking USD46.9 billion in capital commitments, including nine funds targeting USD1 billion or more, which could elevate the 2015 fundraising total closer to the post-crisis peak of USD25 billion in 2011.

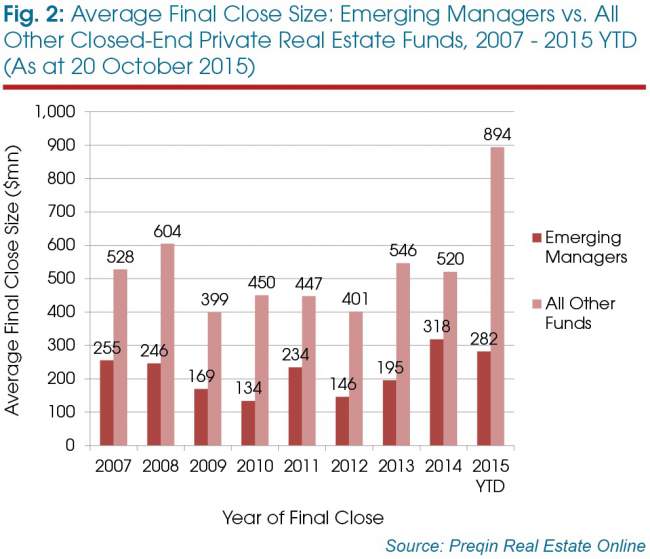

The average final close size of vehicles raised by emerging managers increased to USD318 million for funds closed in 2014, 60 per cent of the average close size of all other funds closed that year (Fig 2). So far this year, the gap has widened between the average final close sizes of funds raised by emerging managers (USD282 million) and all other funds (USD894 million), although this trend may change as more funds reach a final close in Q4.

The proportion of total capital raised for private real estate funds accounted for by emerging managers has declined by 15 percentage points since its peak in 2011 (37 per cent) and has remained below 23 per cent of total capital since 2012. When the fundraising market collapsed from USD138 billion raised by funds closed in 2008 to just USD52 billion in 2009, it might have been expected that investors would have been even more cautious investing with inexperienced managers; however, emerging managers’ market share increased from 22 per cent of aggregate capital raised in 2008 to 27 per cent in 2009, despite raising USD16 billion less from institutional investors than in 2008.

Real estate funds raised by emerging managers are not achieving the same level of success in hitting fundraising targets compared with all other private real estate funds; half of the funds raised by emerging managers that closed in 2014 and 2015 YTD achieved or exceeded their initial target size, while 62 per cent of more experienced managers did the same. However, similar proportions of both types of fund secured more than 125 per cent of their target, while 11 per cent of emerging manager funds achieved less than 50 per cent of their target (versus 4 per cent for all other funds). Over time, however, the proportion of first-time funds closing at or above their target size has increased from 46 per cent in 2012 to 53 per cent in 2015 so far, with the proportion closing below target the lowest since 2010.

Geographic, strategy and property preferences

From 2010 to 2013, North America-focused funds accounted for a growing proportion of emerging manager capital raised, increasing from 39 per cent in 2010 to a significant 67 per cent for funds closed in 2013. However, 2014 saw Europe-focused funds represent 39 per cent of emerging manager capital raised; the corresponding proportion of North America-focused funds declined to 53 per cent. So far this year, North America-focused funds have accounted for a greater share of the total capital raised by emerging managers (62 per cent), with Asia-focused vehicles also increasing by 10 percentage points to 15 per cent of capital.

Higher risk strategies such as opportunistic and value added funds have accounted for the majority (60 per cent) of funds raised since 2010 by new firms, and represent 64 per cent of funds closed by emerging managers in 2015 so far. Interestingly, with the increasing prominence of private debt in institutional investors’ real estate portfolios, 2014 saw nearly half (46 per cent) of the aggregate capital raised by new firms that primarily target real estate debt opportunities, well above its historical average (15 per cent), despite only representing 17 per cent of emerging manager funds reaching a final close. In terms of property preferences, approximately half of emerging manager funds that have reached a final close since 2010 target a diversified range of properties, while a quarter of funds are residential focused.

However, are emerging managers targeting higher risk funds, more niche property types, or less saturated property markets than their more experienced peers? Generally, no; in terms of the number of funds being raised since 2007, similar proportions of emerging and experienced managers have targeted opportunistic and value added funds, developed markets and diversified and residential property.

Long road to capital

Fundraising is a long and difficult process for many real estate firms seeking institutional investor capital. While it is certainly the case that the largest managers can secure billions of dollars in capital relatively quickly – as exemplified by Blackstone Group raising the USD14.5 billion institutional portion of its Blackstone Real Estate Partners VIII in just four months – this is not the norm for most real estate firms, irrespective of experience. The average time taken to reach a final close has remained relatively similar for both emerging managers and all other managers since 2008. For example, since 2008, emerging managers spent an average of 16.4 months raising capital, the same as all other managers. However, for more recent funds closed (2014-2015) there has been a divergence in the time spent marketing vehicles: while experienced managers were on the road for an average of 18.4 months for funds closed in this timeframe, emerging managers have spent two more months in market.

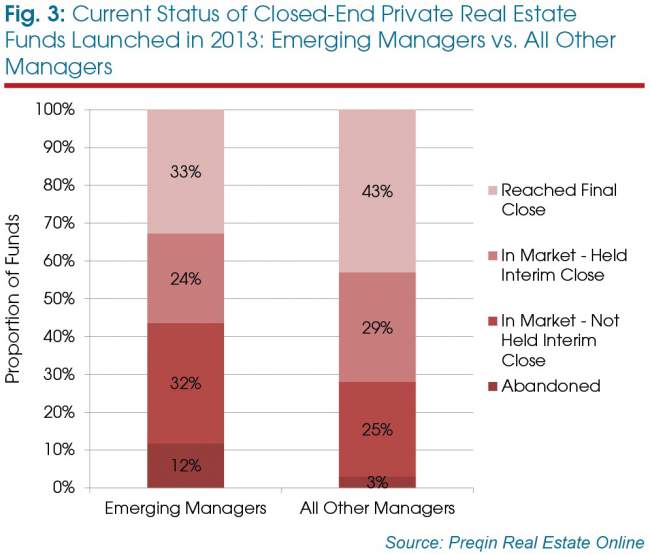

When we examine the fundraising success of funds launched in 2013 (Fig 3), we see that 43 per cent of vehicles launched by experienced managers have reached a final close. In comparison, only 33 per cent of funds launched by emerging managers have closed, indicative of the greater ease with which managers with a longer track record can close funds.

Performance first-time funds

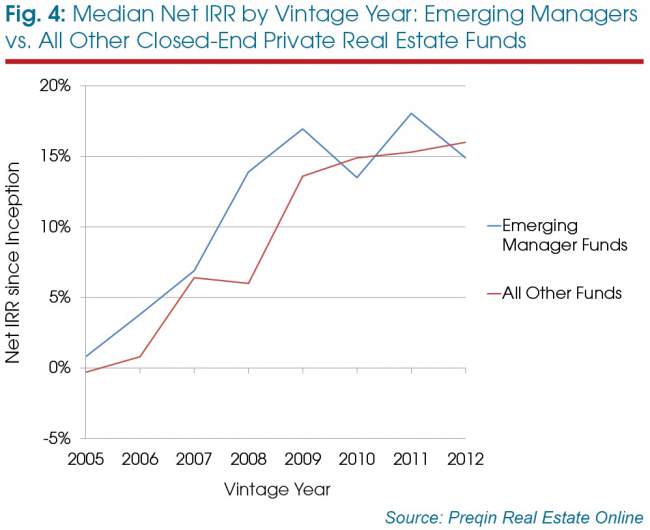

Preqin’s Real Estate Online includes net-to-LP performance data for more than 1,300 named closed-end real estate funds, and the median net IRRs of these vehicles are plotted by vintage year for both emerging manager funds and all other funds in Fig 4. Funds raised by emerging managers have on average frequently outperformed all other real estate funds across all vintage years barring the more recent 2010 and 2012 vintages, with the median net IRR of 2009 vintage funds standing at 17.0 per cent, compared with 13.6 per cent for managers that have raised more than two private real estate vehicles previously.

A good track record is one of the most important factors investors look for during fund selection. However, for investors that have the resources to conduct due diligence on emerging teams, investing with new managers has the potential to be a very successful approach. Thirty-three percent of funds raised by emerging managers are top-quartile performers and 56 per cent achieve returns above the median. This may be because newer managers are typically smaller and may therefore be more nimble, or because the new team is eager to prove its worth.

Institutional investor appetite

Many private real estate investors are increasingly looking for managers with a strong track record, resulting in approximately two-thirds of the private real estate investor population stating that they will not invest in first-time funds, a figure that has remained consistent since 2012. As such, attracting investor capital is often perceived as the biggest challenge faced by emerging managers, particularly in the current market. However, there is a clear correlation between appetite for first-time funds and institutional investor assets under management (AUM). Ninety-one percent of firms with AUM of less than USD1 billion will not invest in first-time private real estate funds, while 41 per cent of firms with over USD50 billion in AUM will invest in new fund managers.

Outlook

With many institutions deciding to invest more capital across fewer relationships, emerging managers have found fundraising tougher than ever. Raising a first- or second-time fund continues to be challenging, with a myriad of factors making the journey to final close a long and difficult process. Fundraising is always a particularly challenging prospect for newly established firms and in a very crowded market with investors increasingly focusing on managers with a long track record, many new firms may instead look to build up a track record through separate accounts or by investing on a deal-by-deal basis, as opposed to bringing multi-investor funds to market.

Despite this, the performance of funds raised by newer real estate firms demonstrates how important it is for investors to consider the full range of funds available in the market. With 477 closed-end private real estate funds currently being marketed, identifying the best opportunities is extremely challenging, but those investors that can pick the best new or emerging managers have the potential to be rewarded.

*For the purpose of this article defined as first- or second-time fund managers.

This article is taken from Preqin Real Estate Spotlight: November 2015; you can read the full newsletter here, which also looks at opportunistic real estate fundraising, South Korean private real estate and more.