Preqin’s latest factsheet takes a detailed look at closed-end private real estate fundraising for emerging managers in Europe.

Fundraising

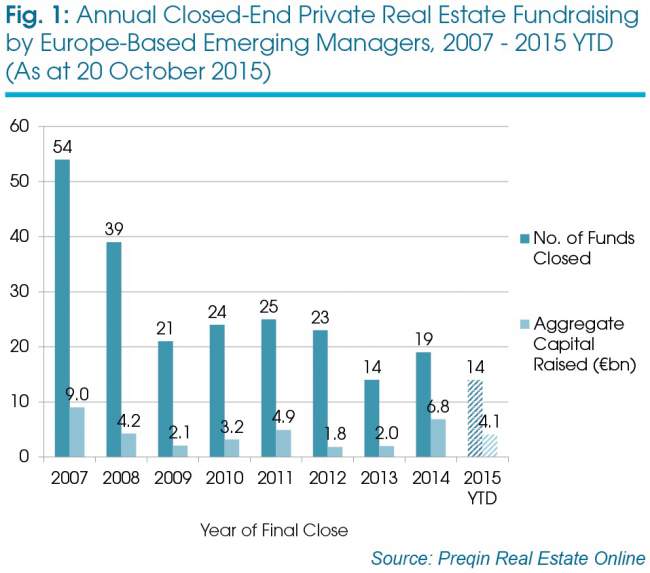

Preqin’s Real Estate Online contains detailed information on 233 private real estate funds managed by Europe-based emerging managers*, which have raised EUR38 billion since 2007. Fundraising by Europe-based emerging private real estate managers has not emulated its pre-crisis peak of 54 funds reaching a final close on EUR9 billion in capital commitments in 2007 (Fig 1). Since then, fundraising has struggled to gain momentum, with an average of 20 funds reaching a final close annually and raising an average of EUR3.5 billion. Despite this, 2014 saw a resurgence in the capital secured, with USD6.8 billion raised, a post-crisis record; this represents three-quarters of the capital raised in 2007, but from just over a third of the number of funds. As it stands, a similar amount of capital to the post-2007 average has been raised by emerging managers in 2015. Indicative of the rising concentration of capital among fewer managers, there are 38 private real estate funds in market that are managed by Europe-based emerging firms, seeking USD12 billion in capital commitments.

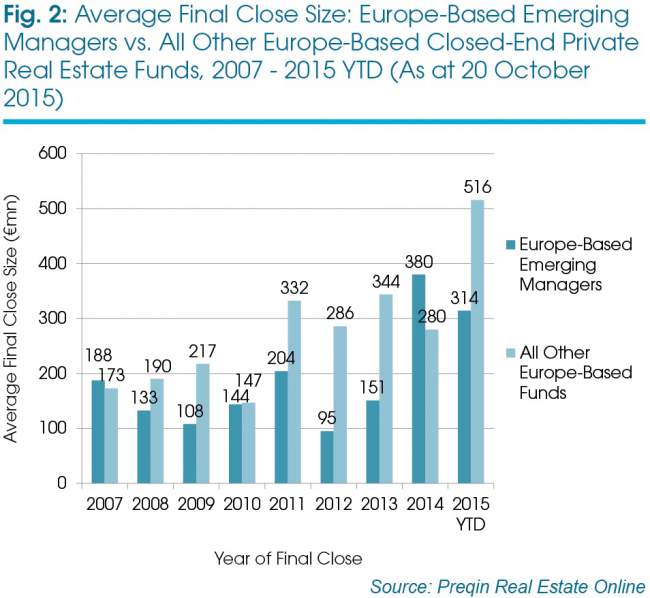

The average final close size of vehicles raised by Europe-based emerging managers increased to USD380 million for funds closed in 2014, higher than the average close size of all other Europe-based funds closed that year (Fig 2). However, the trend has reversed this year and the gap has widened, with the average final close size of funds raised by Europe-based emerging managers (USD314 million) significantly lower than that of all other Europe-based funds (USD516 million).

Generally, Europe-based emerging managers are raising a greater proportion of total Europe-based private real estate capital than their equivalents in the US; 35 per cent of capital raised by Europe-based real estate firms since 2007 is attributed to emerging managers, compared with 20 per cent of US-based capital secured by US-based emerging managers. However, the proportion of total Europe-based capital accounted for by emerging managers has fluctuated year-on-year from a high of 52 per cent in 2010 to a low of 19 per cent in 2013.

The largest proportions of funds closed and aggregate capital raised by Europe-based emerging managers since 2007 have been for higher risk opportunistic and value added strategies, although the increasing prominence of real estate debt funds over recent years has led to the strategy securing a fifth of aggregate Europe-based emerging manager capital. Unsurprisingly, most Europe-based emerging firms are more comfortable investing capital close to home; 95 per cent of funds closed by emerging managers have focused on real estate in their domestic continent.

Investor appetite

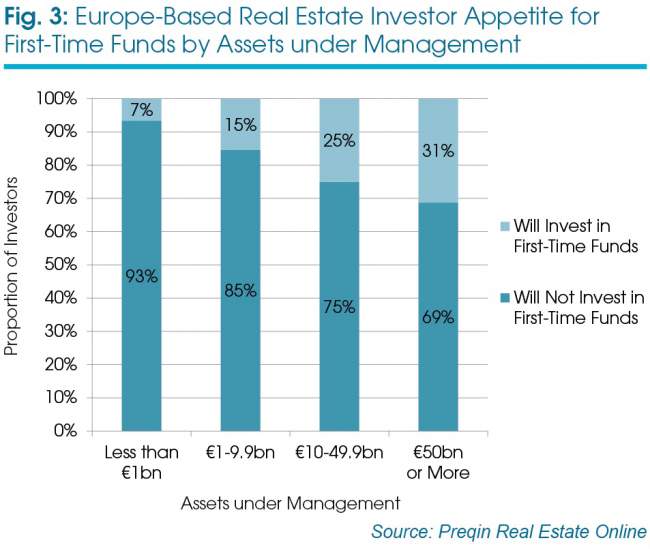

Preqin’s Real Estate Online contains detailed information on over 1,400 Europe-based institutional investors active in real estate, including their attitudes towards investment with less experienced managers. Many private real estate investors look for managers with a strong track record, resulting in 70 per cent of the Europe-based investor population stating that they will not invest in first-time funds. As such, attracting investor capital is often perceived as the biggest challenge faced by emerging managers, particularly in the current market. However, there is a clear correlation between appetite for first-time funds and institutional investor assets under management (AUM). Ninety-three percent of firms with AUM of less than USD1 billion will not invest in first-time private real estate funds, while 31 per cent of firms with over USD50 billion in AUM will invest with new fund managers (Fig 3).

This article is an extract from Preqin’s latest factsheet, focusing on the fundraising US-based emerging managers in the private real estate industry. Read full factsheet here.