Many investors choose to disregard potential investment in an infrastructure fund due to terms and conditions. Utilising information from the 2015 Preqin Private Equity Fund Terms Advisor and the Preqin Investor Outlook: Alternative Assets, H2 2015, this extract from this month’s Preqin Infrastructure Spotlight examines the fund terms and conditions of unlisted infrastructure funds and their effect on the alignment of interests between investors and fund managers.

In Q3 2015, Preqin conducted a series of detailed interviews with active institutional investors in infrastructure in order to gain insight into their attitudes towards the asset class. The study revealed that investor appetite for infrastructure is strong, with 79 per cent of respondents expecting to commit more capital or the same amount to unlisted infrastructure funds in the coming 12 months as in the previous year.

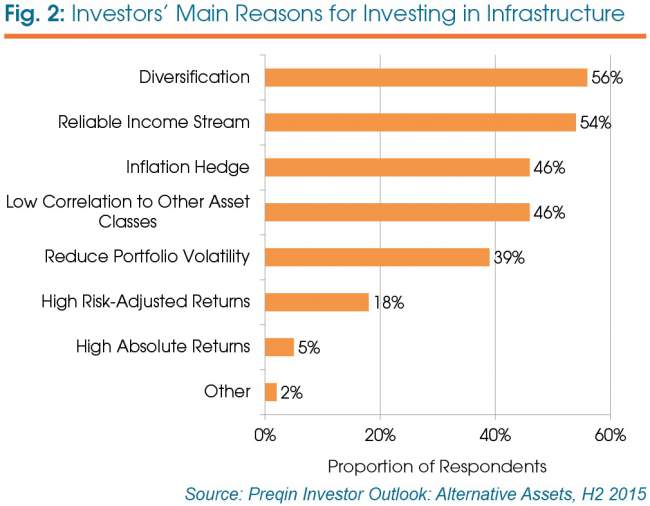

Competition for investor capital remains intense, with over 170 unlisted infrastructure funds in market. Although established fund managers with strong track records have had significant fundraising success, they will need to carefully consider the terms and conditions of their new funds to align with changing market conditions; this will ensure they do not dissuade prospective investors, and that they are able to justify differing fees. It is crucial for fund managers attempting to secure these commitments to understand why investors are choosing infrastructure investments in order to develop terms to suit.

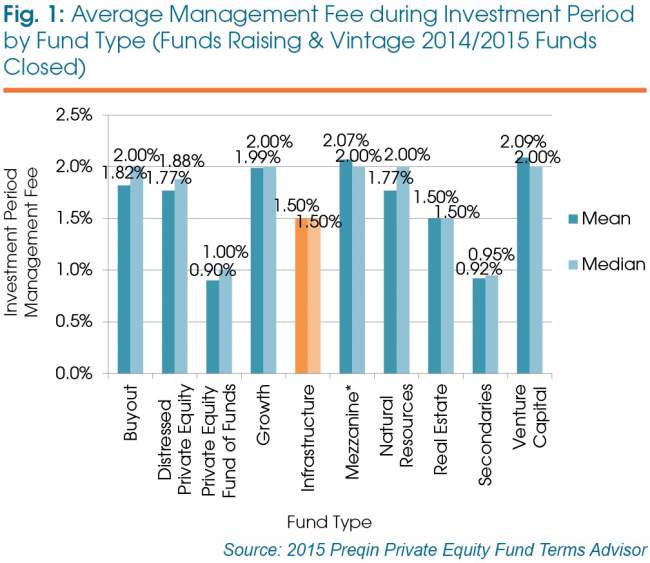

Management fees

Fig 1 shows that the mean management fee is approximately 2.00 per cent for most private equity-style fund strategies (funds currently raising or with a 2014/2015 vintage). Unlisted infrastructure funds have some of the lowest management fees of any private equity-style investment strategy (1.50 per cent), reflective of the main reasons investors choose infrastructure (Fig 2). While the private equity fee model may be suited to higher risk/return strategies, most infrastructure investors are looking for fees to reflect the types of assets being invested in and the levels of returns expected when gaining exposure to lower risk/return infrastructure assets.

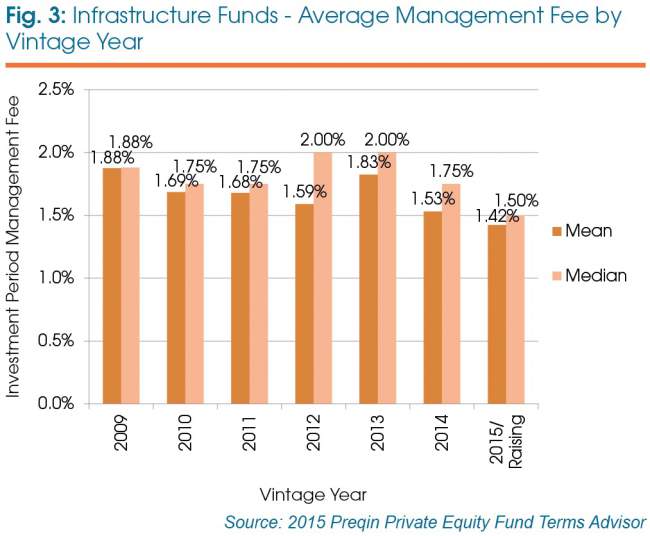

The market has evolved over time to reflect investor demands, with fund managers making greater concessions in this area to attract investor commitments. The average management fee for infrastructure funds has been falling over recent years, with the median at 1.50 per cent for most recent funds (Fig 3).

Despite the average management fee falling over recent years, a large proportion of funds (37 per cent) still charge a management fee of 2.00 per cent – the maximum management fee charged by any of the funds in the sample. However, this also shows how fund managers have evolved in terms of making concessions to investors; for funds of vintage years 2012 and 2013, a significant 61 per cent charged a management fee of 2.00 per cent or more.

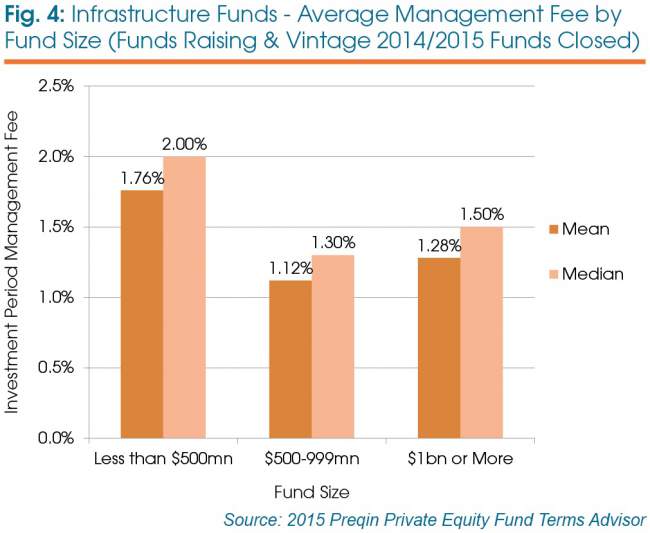

The size of the infrastructure fund has a clear impact on the management fee charged, with larger funds generally charging less than smaller funds. Fig 4 shows that infrastructure funds sized USD500-999 million had the lowest mean and median fees – 1.12 per cent and 1.30 per cent respectively – whereas funds in the USD1 billion or larger category interestingly charge slightly higher fees, with a mean management fee of 1.28 per cent. Smaller infrastructure funds (less than USD500 million in size) have the highest average fee at 1.76 per cent, although this is still below the 2.00 per cent average for private equity as a whole.

Alignment of interests

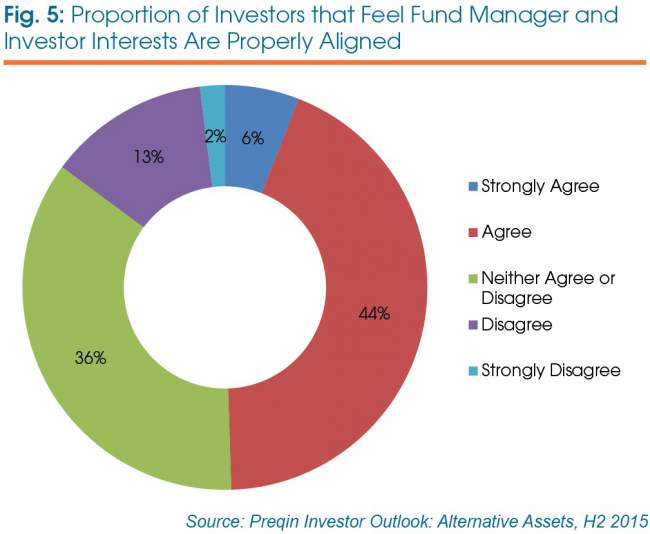

The alignment of interests between the two parties is central to creating a positive relationship and driving further capital commitments from the investor. As shown in Fig 5, a substantial 86 per cent of surveyed investors feel that investor and fund manager interests are properly aligned, or do not have a strong opinion either way. This compares to the 51 per cent of surveyed investors which stated the same in June 2013, suggesting that fund managers have largely listened to concerns regarding fees and the growing requirement to adopt terms that better meet investors’ needs.

Outlook

In an increasingly competitive unlisted infrastructure fundraising market, investors are more discerning than ever before regarding where they place their capital. A delicate balance now exists between appropriate compensation for performance and securing investor commitments; for fund managers, getting this balance right could determine whether or not a successful fund close is achieved. The vast majority of investors responding to a study conducted by Preqin at the end of H1 2015 have decided not to invest in an unlisted infrastructure fund due to the proposed terms and conditions, demonstrating how important terms and conditions have become. It is vital that fund managers structure the terms and conditions of their funds appropriately to prevent the potential loss of institutional capital commitments. This is particularly the case for managers without a proven track record in the space, or those unable to illustrate successful past performance, as they cannot justify terms outside the market standard.

This article is taken from November’s edition of Preqin Infrastructure Spotlight, which also examines the South Korean infrastructure market, 2015’s Indian infrastructure deals and much more.