With Blackstone Group’s latest opportunistic offering, which closed in Q3, becoming the largest private real estate fund of all time, Preqin’s Lauren Mason takes a look at fundraising for the strategy and the pipeline of opportunistic funds in market.

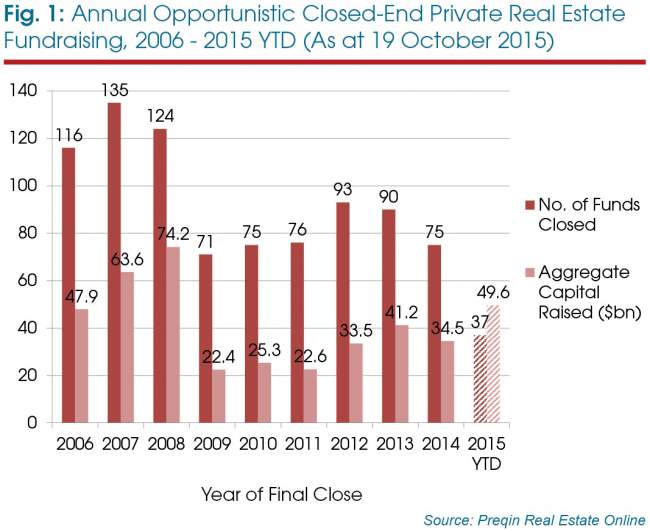

Although the total number of opportunistic funds reaching a final close each year has declined since 2012, the aggregate capital raised by these funds is at a post-crisis high: 37 opportunistic private real estate funds have reached a final close this year, raising USD49.6 billion in institutional investor commitments (Fig 1). Fifty-five percent of total capital raised in 2015 has been secured by one-quarter of all private real estate funds closed this year, and further demonstrates the level of capital concentration among fewer real estate firms.

Geographic make-up

North America has dominated fundraising for opportunistic private real estate funds recently, with 57 per cent of capital raised by primarily opportunistic funds in 2014 and 2015 focusing on the region. In the same timeframe, 19 opportunistic funds raised an aggregate USD21.3 billion for investment in European markets, while 22 Asia-focused funds have raised a considerable USD14.2 billion.

Fund marketing challenges

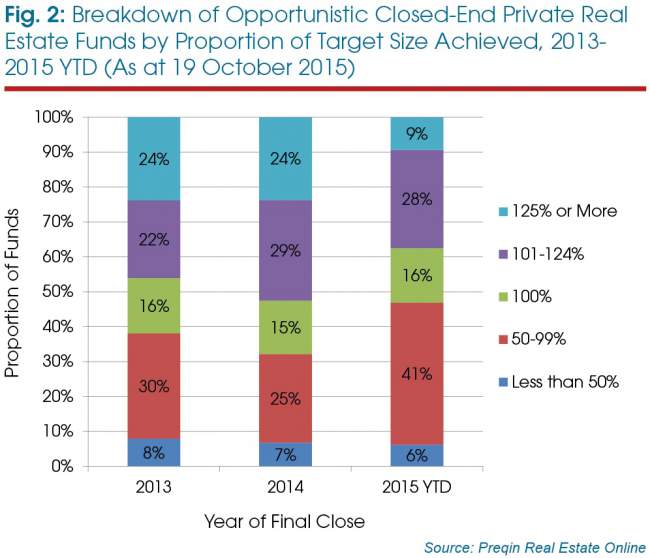

Of the opportunistic vehicles closed this year so far, the majority (53 per cent) have met or exceeded their initial target size; however, this is less than the proportion seen in both 2013 (62 per cent) and 2014 (68 per cent), as shown in Fig 2. While fund managers are having success in meeting or achieving targets, they are spending an increasingly long time on the road: real estate firms have taken an average of 19.4 months to reach a final close for opportunistic funds, up from 14.8 months in 2013, reflecting the challenges firms face when marketing their funds.

Strong competition

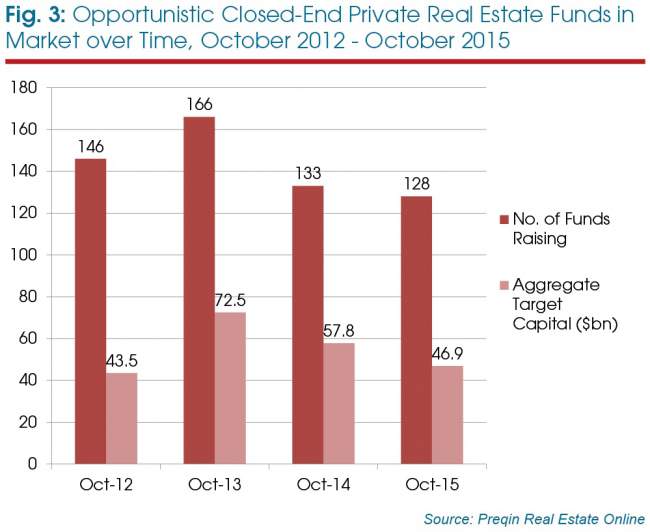

Despite a small decrease in the number of opportunistic funds in market compared to previous years, the opportunistic real estate fund market remains competitive (Fig 3). As of October 2015, there were 128 primarily opportunistic funds on the road, targeting USD46.9 billion in capital commitments, a slight reduction on the 133 funds on the road in October 2014 that were targeting USD57.8 billion. This decrease in the number of opportunistic funds on the road and the volume of capital they are targeting does not necessarily demonstrate falling confidence from fund managers in their ability to attract capital for this strategy. There are 10 opportunistic funds in market that are targeting over USD1 billion in investor capital, including Brookfield Asset Management’s Brookfield Strategic Real Estate Partners II. The fund is targeting USD7 billion for opportunistic investment in commercial property and real estate operating companies globally, and would become the fourth largest real estate fund of all time.

Investors targeting opportunistic real estate

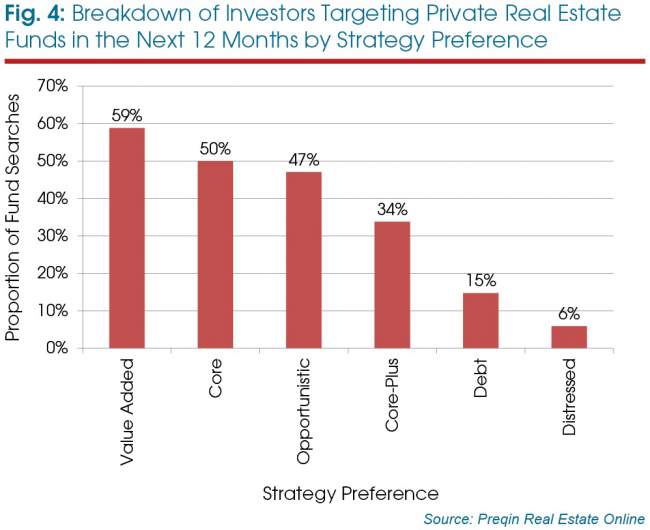

As seen in Fig 4, there is strong appetite from institutional investors for opportunistic funds; nearly half of the investors searching for funds profiled on Preqin’s Real Estate Online are targeting opportunistic funds in the next 12 months.

Outlook

Opportunistic fundraising reached a post-crisis record this year: the strategy has contributed its largest ever share of total real estate fundraising. In part, this is due to the largest ever private real estate fund reaching a final close this year – although, even without this, 2015 fundraising should comfortably surpass 2014 capital totals. However, the market is different now: capital is far more concentrated among the largest, most experienced managers; brand name real estate firms such as Blackstone, Starwood Capital Group and Lone Star Funds have all closed some of the largest ever opportunistic offerings in 2015. With pricing of core assets a concern for some institutions, many have moved up the risk/return spectrum to focus on opportunistic strategies, a trend that looks set to continue in 2016.

This article is taken from Preqin Real Estate Spotlight: November 2015; you can read the full newsletter here, which also looks at emerging managers in the asset class, South Korean private real estate and more.