Investors’ plans for future activity in the private debt space are revealed in this extract from the Preqin Quarterly Update: Private Debt, Q1 2015.

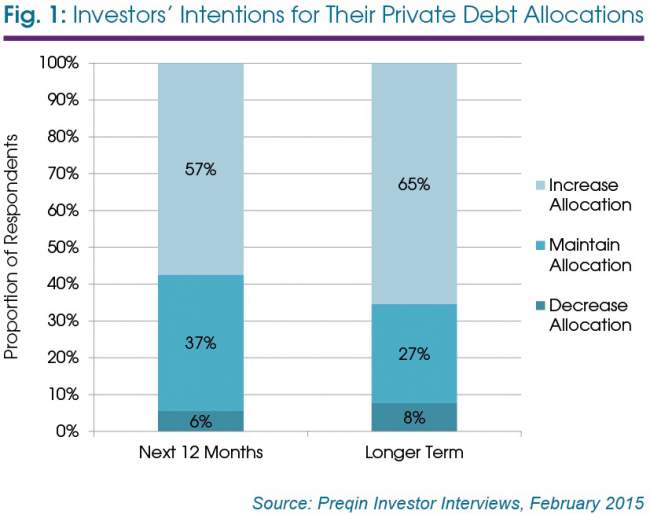

Investors surveyed by Preqin in Q1 2015 conveyed a strong appetite for exposure to private debt funds, with 57 per cent of respondents expecting to increase their allocation within the next 12 months (Fig. 1). An even larger proportion (65 per cent) expects to increase their allocation to private debt in the longer term, while only 8 per cent expect to decrease their exposure. It is clear that institutional investors are becoming increasingly familiar with the sub-strategies within private debt, and have shown a favourable outlook on well-performing or promising areas of the asset class.

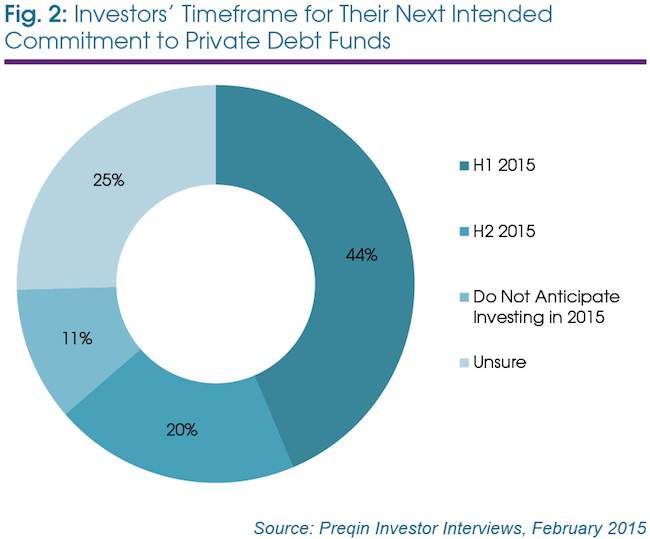

Looking further into activity in 2015, 44 per cent of respondents plan to make their next commitment in the first half of the year, with 20 per cent anticipating making a commitment during the second half of 2015, as shown in Fig. 2. Only 11 per cent of respondents do not anticipate investing in private debt during 2015, with the remaining 25 per cent unsure of commitment plans.

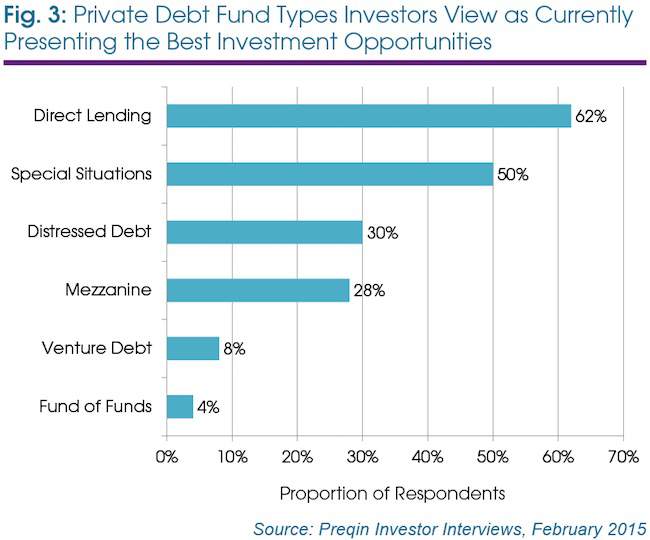

In terms of fund types within private debt considered as currently presenting the best investment opportunities, 62 per cent of respondents view direct lending as the most promising type, an unsurprising conclusion after fundraising success within the strategy in 2014. Furthermore, half of respondents identified special situations as presenting strong opportunities, followed by distressed debt (30 per cent) and mezzanine (28 per cent).

Europe is currently viewed as presenting the most favourable investment opportunities for 69 per cent of investors, followed by North America (57 per cent) and Asia (14 per cent).

Preqin releases quarterly reports covering private equity, hedge funds, infrastructure, real estate and private debt. All five quarterly updates can be accessed for free in our Research Center.