Preqin’s Real Estate Online currently tracks 62 South Korea-based institutions that are actively investing in the real estate asset class, collectively representing USD2.5 trillion in total assets.

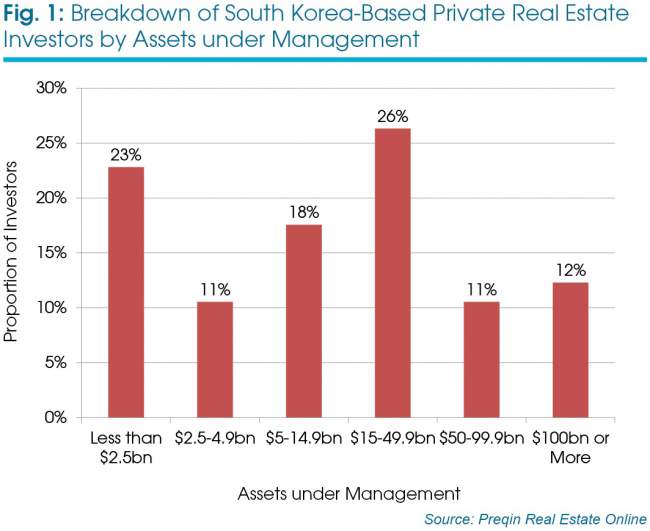

A large proportion of South Korea-based real estate investors are insurance companies (31 per cent) and banks or investment banks (27 per cent), with public pension funds (18 per cent) and asset managers (10 per cent) also making up notable proportions of the investor pool. With 85 per cent of the real estate investor population comprising these traditionally large institutions, it is unsurprising that nearly half hold more than USD15 billion in assets under management (AUM), although nearly a quarter of investors have less than USD2.5 billion in AUM (Fig 1).

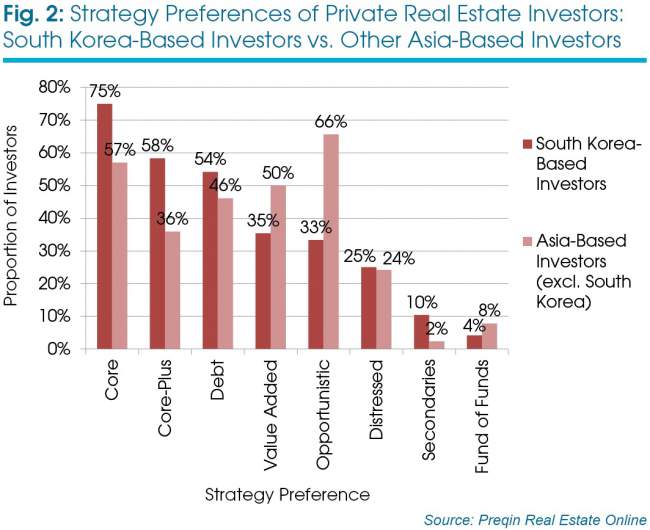

Most likely due to their size, South Korea-based investors are more likely to invest directly in the asset class than their peers in the rest of Asia. However, they also display a far greater propensity to invest in private real estate funds than their Asia-based counterparts; 85 per cent of South Korea-based real estate investors will invest through private real estate funds, compared with approximately half of real estate investors in the rest of Asia. South Korea-based institutions are typically more risk-averse than other Asia-based investors when investing in real estate; 75 per cent and 58 per cent of South Korea-based private real estate investors target core and core-plus vehicles respectively, compared with 57 per cent and 36 per cent of other Asia-based investors (Fig 2). Furthermore, approximately one-third of South Korea-based investors will target higher risk value added and opportunistic funds each, while 50 per cent and 66 per cent of other Asia-based private real estate investors will target those funds respectively.

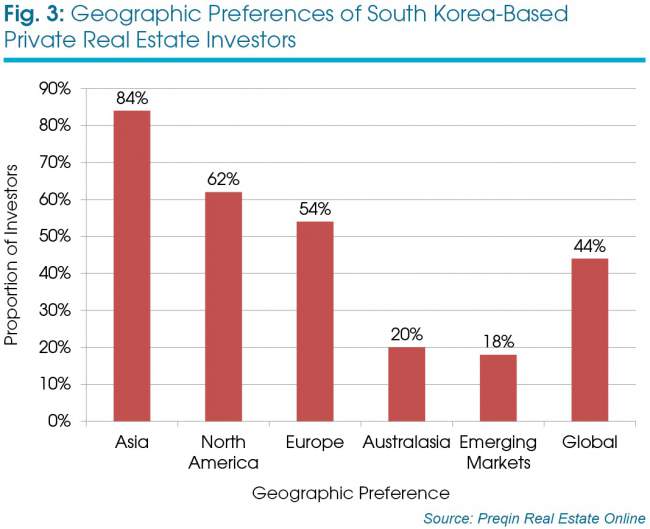

In terms of their geographic preferences, the largest proportion (84 per cent) of South Korea-based investors will target real estate funds focused on their domestic region, although many will still target the traditional real estate markets in North America (62 per cent) and Europe (54 per cent), as shown in Fig 3.

The South Korea-focused private real estate market is relatively small; Preqin’s Real Estate Online tracks 20 funds that have reached a final close since 2007, raising a combined USD1.9 billion, although no vehicles have closed post-2013. Despite the preferences of South Korea-based institutional investors, the largest proportion of funds reaching a final close since 2007 have been opportunistic (40 per cent), although 36 per cent of the total capital raised was for funds following a core-plus strategy. The majority (70 per cent) of funds that have reached a final close have been raised by South Korea-based managers, although the largest private real estate fund to close was managed by US-headquartered Prologis; ProLogis Korea Fund reached a final close on USD250mn and focuses on newly developed, stabilized properties.

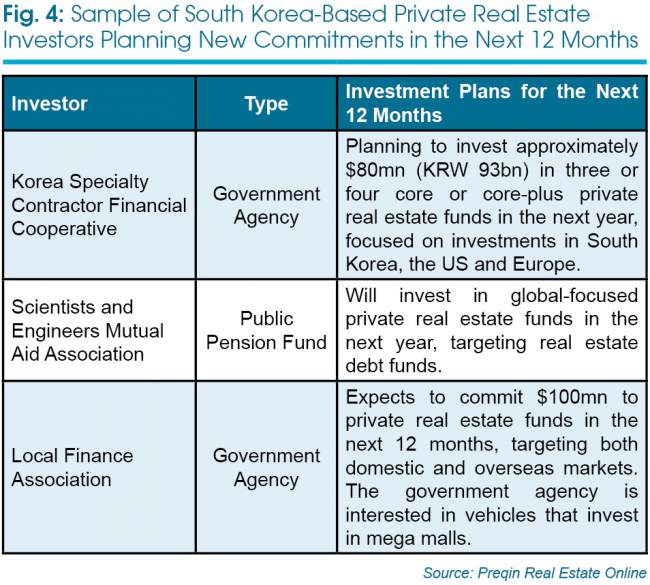

The charts and tables in this article feature in a recent factsheet. View the full factsheet for further analysis.