In an extract from the recently launched 2015 Preqin Sovereign Wealth Fund Review, Lauren Mason, Amy Bensted and Oliver Senchal provide an insight into this secretive and exclusive subset of the investor community.

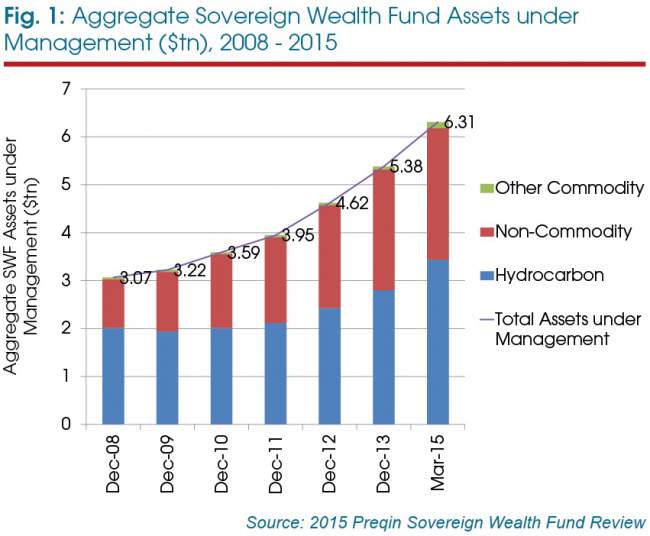

Sovereign wealth funds, despite being small in number and secretive in nature, continue to capture attention as a result of their ever growing assets under management and corresponding influence on global financial markets. Today, the total assets of sovereign wealth funds top USD6.31tn (Fig 1), more than double the capital these entities represented in 2008, the year Preqin launched its first Sovereign Wealth Fund Review.

Investing in Real Estate

Traditional investments, such as equities and fixed income securities, are widely used by sovereign wealth funds and are a relatively stable part of the portfolios of these investors. Alternative assets have emerged as an increasingly important portion of the portfolios of many sovereign wealth fund investors over recent years, as these investors seek to diversify their portfolios and acquire assets that can generate yield and help them meet their long-term objectives.

Investments in real assets are the most common route into alternative investment by sovereign wealth funds in 2015, with significant growth in the proportion of sovereign wealth funds that allocate capital to real estate since the publication of the 2013 Preqin Sovereign Wealth Fund Review. The increased appetite for real estate from sovereign wealth funds and other institutional investors, the improving fundraising environment and increases in real estate asset valuations have enabled the private real estate market to enjoy a period of success; private real estate assets under management reached an all-time high of USD742 billion at the end of 2014. In March 2015, Blackstone closed the largest ever closed-end real estate fund after successfully raising USD14.5 billion, USD1.5 billion more than it targeted. Among the investors in this fund is the sovereign wealth fund New Mexico State Investment Council, which allocated USD75 million to the record-breaking vehicle.

Over half (59 per cent) of all sovereign wealth funds currently invest in real estate. This comprises some of the largest sovereign wealth funds in the world, including Abu Dhabi Investment Authority (ADIA), GIC and Kuwait Investment Authority, which all have over USD18 billion allocated to real estate. Nearly a third of all sovereign wealth funds do not invest in real estate, often due to government mandates preventing them from doing so. The Kevin P Reilly Sr Louisiana Education Quality Trust Fund is one such investor that does not invest in the asset class due to state laws restricting its investments to only equities and fixed income.

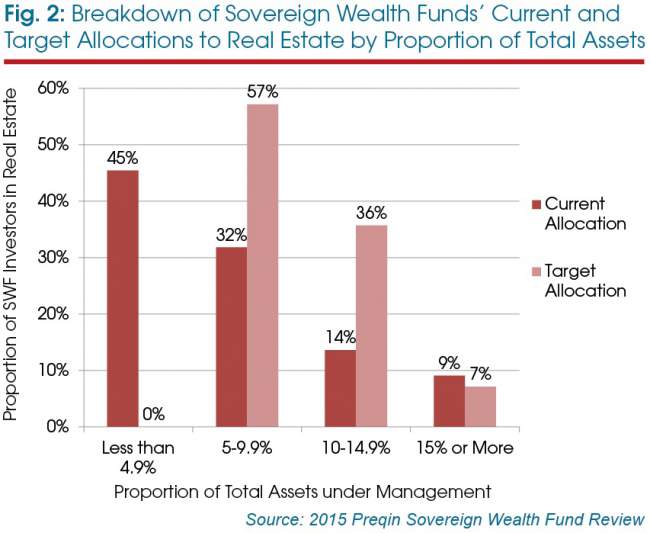

As shown in Fig 2, the majority of sovereign wealth funds are under-allocated to the asset class. While 77 per cent of sovereign wealth funds currently allocate up to 9.9 per cent of their total assets to real estate, 93 per cent have a target allocation of between 5 per cent and 14.9 per cent, indicating the potential for inflows to the asset class as sovereign wealth funds move closer to their strategic targets. However, one of the largest allocators to real estate, as a proportion of total assets, is Alberta Heritage Savings Trust Fund, which currently allocates 19.6 per cent of its total assets to real estate, above its target allocation of 17.5 per cent. The majority of its real estate portfolio is dedicated to direct property investments, but it also has exposure to private real estate funds.

Total Assets under Management

Historically, larger sovereign wealth funds, with the capabilities and expertise to run a globally diversified portfolio, have shown a greater preference for investing in real estate; all sovereign wealth funds with over USD100 billion in assets are currently investing in the asset class. The USD773 billion ADIA invests between 5 per cent and 10 per cent of total assets to real estate through direct, listed and private real estate. Conversely, smaller sovereign wealth funds are less likely to invest in real estate. Forty-one percent of funds with total assets of USD1-9.9 billion are investors in real estate, while only 13 per cent of funds with less than USD1 billion in assets invest in the asset class. The USD3 billion North Dakota Legacy Fund has its real estate portfolio entirely invested in private real estate funds, indicative of larger sovereign wealth funds having the capabilities and capital to access the asset class through all routes to market; smaller funds have a more limited scope, if at all.

Location

Real estate investments are most attractive to North America-based sovereign wealth funds, with 90 per cent of sovereign wealth funds based in the region investing in real estate. High proportions of real estate investors are also found in Asia (76 per cent) and the MENA region (65 per cent), likely due to the sizeable assets managed by many of the sovereign wealth funds in these two areas providing the requisite capital to engage in a diversified global real estate program.

However, sovereign wealth funds based in sub-Saharan Africa and Europe are less likely to invest in the asset class. Furthermore, none of the sovereign wealth funds based in Latin America invest in the asset class. The majority of these Latin America-based investors are stabilization funds that require liquid portfolios; therefore, real estate investment does not fit this criterion.

Route to Market

Sovereign wealth funds look to gain access to real estate in a wide variety of ways, with many utilizing a number of routes to market. The majority of sovereign wealth funds look to invest in the asset class directly. One such investor is International Petroleum Investment Company, which has 3.1 per cent of its total assets dedicated solely to direct real estate. The sovereign wealth fund’s portfolio consists of investments in land and commercial property located in the United Arab Emirates.

Sixty-four percent of sovereign wealth funds invest in real estate through private funds, such as New Zealand Superannuation Fund (NZSF), which gains exposure to the asset class through all routes to market, including private real estate. NZSF will continue to be opportunistic towards new private real estate fund commitments over the coming year. It maintains a global outlook and will invest in a range of non-core strategies.

Listed real estate is a preference for 32 per cent of sovereign wealth funds investing in real estate. Only one fund invests solely in listed real estate, National Social Security Fund – China; however, it has recently been given permission to invest in both domestic and overseas private real estate funds.

International Direct Real Estate Holdings

Developing a direct real estate portfolio is an option for sovereign wealth funds with the resources to do so, allowing greater control over the management of real estate assets. Additionally, many acquire landmark properties in major cities, although these capital-intensive trophy assets are mainly the preserve of the largest sovereign wealth funds. ADIA’s direct real estate portfolio makes up approximately two-thirds of its real estate investments. Qatar Investment Authority (QIA) also has a large real estate portfolio, which includes assets such as London’s Harrods, The Shard and Canary Wharf.

Another example of a large direct portfolio is that of Government Pension Fund Global, which bought Queensbury House in London from Italy-based fund management group Sorgente for GBP190.6 million in Q1 2015. Even though it is a relatively new real estate investor, it has also acquired a 45 per cent stake in 11 Times Square in New York City, which is valued at USD1.4 billion and due to be 90 per cent let with Microsoft and Proskauer as anchor tenants.

Private Real Estate Preferences

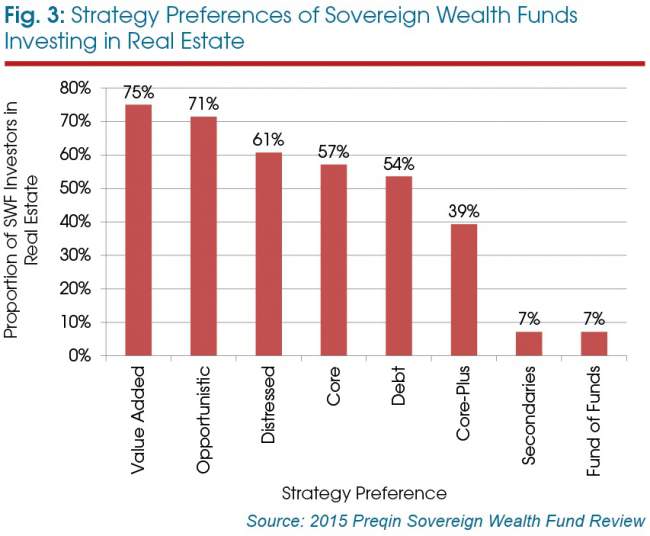

In terms of private real estate funds, value added and opportunistic vehicles remain the preferred strategies of sovereign wealth funds, with 75 per cent and 71 per cent respectively investing in the fund types. This also shows that value added funds have overtaken opportunistic vehicles as the most frequently targeted strategy among sovereign wealth funds when compared to results gathered in 2013, when 65 per cent of sovereign wealth funds stated a preference for value added vehicles while 74 per cent stated a preference for opportunistic vehicles. Secondaries and fund of funds vehicles are the least favoured strategy of sovereign wealth funds, as the level of sophistication and capital potential of these investors typically enable them to access the asset class through primary fund commitments.

Regional Preferences

North America remains the most attractive region for sovereign wealth funds’ real estate investments, with 59 per cent of these investors favouring the region. However, this figure has decreased from 72 per cent in 2013, which indicates a growing preference for a more global approach to private fund investments as these investors further diversify their real estate portfolios. Europe maintains its status as a real estate investment destination, with 55 per cent of sovereign wealth funds favouring the region, as does Asia (50 per cent).

Only sovereign wealth funds based in the MENA region have expressed an interest in investing in MENA-focused real estate, with 30 per cent indicating a preference for the region. Many MENA-based sovereign wealth funds are mandated to focus primarily on domestic investments, although some also have global exposure, such as QIA, which predominantly invests in direct domestic real estate and also invests in the wider MENA region, in particular Morocco, Egypt, Syria and Oman; other than its MENA-focused investments, it also has exposure to the UK, Europe and the US.

Outlook

Real estate remains a key component of many sovereign wealth fund portfolios and the asset class is now only one percentage point behind infrastructure as the preferred alternative asset for this group of investors. Typically making the news for trophy asset direct acquisitions in global hubs, sovereign wealth funds also frequently invest through indirect routes to market. The large assets under management make sovereign wealth funds increasingly important sources of capital for the real estate asset class, and as they grow their real estate allocations, it is likely that there will be further diversification of these investors’ portfolios. Some sovereign funds have established more local offices to increase the number of people on the ground in local markets, and it also seems likely that, while noted for buying large trophy assets, sovereign wealth funds may also target a wider range of markets in the coming years.

This is an extract from the Preqin Real Estate Spotlight: May 2015. Click here to read the full Spotlight for free.