In this extract from Preqin Infrastructure Spotlight – June 2015, Stephen Yates looks at the 100 largest institutional investors in infrastructure and the extent to which they influence the asset class, examining their make-up, investment preferences and future plans.

A growing number of institutional investors are moving into the infrastructure space owing to the potential for stable and predictable long-term yield, as well as the diversification and inflation-hedging characteristics available through a conservatively managed infrastructure portfolio. At present, Preqin’s Infrastructure Online platform tracks almost 2,300 institutional investors actively investing in the asset class, with an additional 205 investors potentially investing in the near future. In this article we look at the 100 institutions with the most capital allocated to infrastructure; some were early pioneers in private sector infrastructure investment, others are more recent entrants, but as a group these institutions wield considerable influence on the infrastructure market globally.

The 100 largest institutional investors in infrastructure (by capital committed) currently have an aggregate USD240bn invested in the asset class, representing a 31% increase on the aggregate total investments made by the top 100 investors at the same stage in 2012, and a 13% increase on 2013. In comparison, the next 100 largest allocators to infrastructure have an aggregate USD37bn invested in the asset class.

Geographic location

In terms of geographic location (Fig 1), Australia (15), Canada (14), the US (14) and the UK (12) account for the highest number of investors in the top 100, reflective of the developed infrastructure markets in these locations. Europe is the most prominent region, home to 38 of the top 100 institutions, compared to 28 based in North America, 16 in Australasia and 15 in Asia. The growth of Asia-based infrastructure investors in the top 100 is a remarkable shift, having represented just five of the 100 largest institutional investors in 2012. This is likely due to the growing participation of countries such as South Korea, China and India within the asset class. China’s proposed establishment of the Asian Infrastructure Investment Bank (AIIB) is an illustration of the growing influence of Asian institutions.

Current and target allocations

Due to the relative youth of the infrastructure asset class, institutional investors typically allocate a relatively small proportion of their assets under management (AUM) to infrastructure when compared with other alternative asset classes. However, as expected, the average allocation of the top 100 institutional investors is substantially larger than the average among all other infrastructure investors. Current allocations among the top 100 investors have grown significantly since 2013; the average allocation to infrastructure of this group stands at 6.4%, a 33% increase on 2013’s average. In comparison, growth in current allocations for the rest of the infrastructure investor population has been more modest; while there has been a 20% increase from 2010, current allocations have remained fairly static since 2013.

Similarly, the top 100 institutional investors increased target allocations from 5.9% in 2010 to 6.9% in 2015 YTD, a 17% increase over the five-year period. Conversely, target allocations of the remainder of institutional investors in infrastructure have increased by only 7%. With the infrastructure asset class becoming an increasingly congested space, competition for assets is high, with large numbers of LPs competing over fewer available assets. Therefore, those investors outside the top 100 that may have established ambitious target allocation sizes when first entering the marketplace are now restructuring portfolio allocation sizes to levels that are more appropriate and realistic in relation to the opportunities that the current environment provides. Contrastingly, the larger investors benefit from their size; larger pools of available capital and in-house investment teams provide greater access to infrastructure investment opportunities, something that eludes smaller firms with less experience. This could potentially lead to the infrastructure market becoming increasingly bifurcated, as the largest investors continue to work towards increasingly large target sizes in the coming years.

Investment Strategy

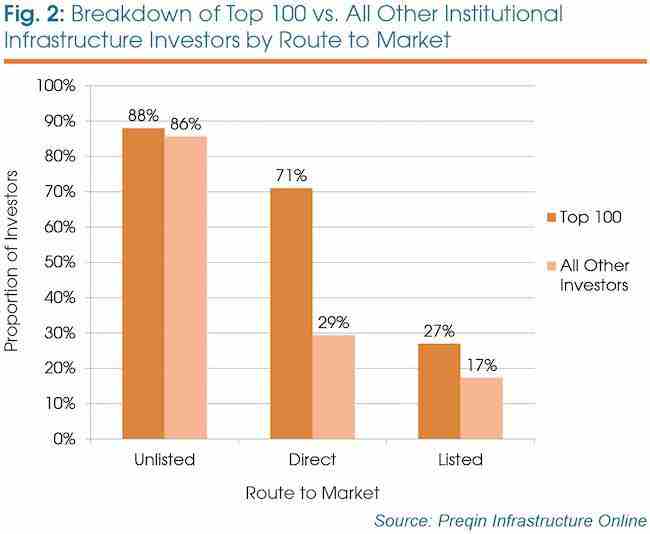

It is not surprising that there is a large gulf in the proportion of firms that will utilize a direct investment strategy: 71 of the top 100 institutional investors will look to utilize a direct investment strategy, compared to just 29% for remaining active investors in the asset class (Fig 2). In recent years, there has been a growing tendency among larger investors to build up in-house capabilities to invest directly in projects in order to gain greater control of their investment portfolios and reduce fees. Despite this, unlisted funds remain the primary route to market for the majority of infrastructure investors worldwide.

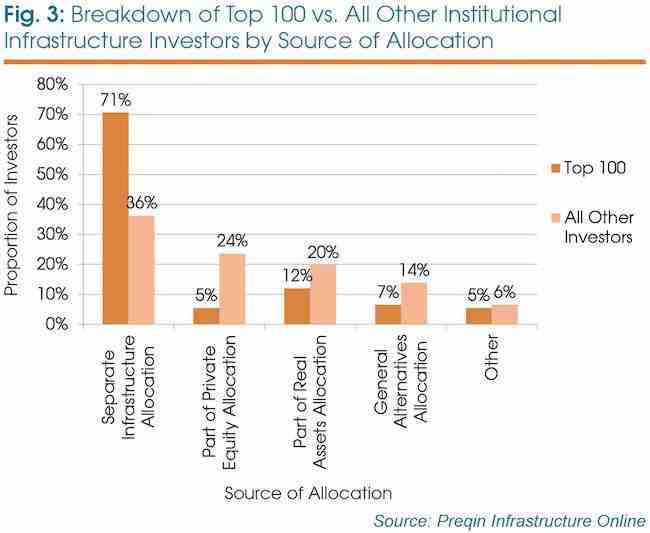

Investors in infrastructure allocate capital to the asset class in a variety of ways; however, a significantly higher proportion of investors in the top 100 invest through a separate infrastructure allocation in comparison to the rest of the population (Fig. 3). This discrepancy is due to the newer entrants in infrastructure preferring to invest through other allocations while they build expertise.

Notable investors in top 100

Ontario Municipal Employees Retirement System (OMERS) remains the largest institutional investor in infrastructure, with CAD 14.4bn invested solely in direct infrastructure projects. The public pension fund is currently below its 25% target allocation, and will continue to be active in acquiring infrastructure assets over 2015, recognizing Australia as a strategically significant market in which it expects to make investments in infrastructure and natural resources.

The biggest rise in the top 20 from 2014 is Canada-based Public Sector Pension Investment Board, which rose from 16th position to 9th in the table. The public pension fund’s CAD 6.8bn infrastructure portfolio includes commitments to unlisted funds, listed funds and direct investments, gaining exposure to a wide variety of economic infrastructure. Over the next 12 months, the pension fund will make investments globally on a case-by-case basis through all routes to market.

Outlook

The top 100 infrastructure investors play a vital role in the infrastructure industry, not just for the notable amounts of aggregate industry capital they represent, but also for the influence their investment activity has on the development of infrastructure in local markets. These investors continue to impact the market, most notably for their direct investments, but given that many of these investors were some of the first to access the asset class, we might expect more recent entrants to grow their allocations to similar levels in the coming years.

This is an extract from Preqin Infrastructure Spotlight – June 2015, which also examines the Asian infrastructure market and brings you the latest Preqin infrastructure data. Read the full newsletter here for free.