A majority of the UK private equity and real estate industry believes that a ‘soft’ Brexit will help fundraising. Similarly in the US, political instability is having a negligible effect on US mangers’ ability to raise funds from investors, according to research from Augentius, one of the world’s largest independent private equity and real estate fund administrators.

The findings come from Augentius’ 2017 summer survey, and form part of a snapshot of sentiment across the global private equity and real estate industry, based on a survey of 100-plus investors and managers. The full report can be downloaded here

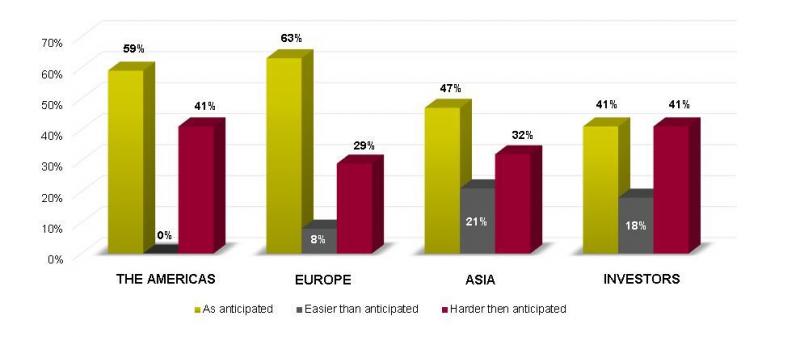

The findings reveal that, despite the political turbulence in Europe and the US, the industry is showing resilience: a majority of managers in the US, Europe and Asia, as well as investors, are finding 2017 to be as anticipated or easier than anticipated.

On the specific issue of portfolio investment/divestment, US and European managers along with investors, are also finding 2017 to be no more challenging than they predicted. In Asia, however, a slim majority of managers are finding this year more difficult than expected.

Brexit

The shock election result, along with details of the ongoing negotiations, has renewed the prospect of a ‘soft’ rather than ‘hard’ final Brexit settlement. A majority of UK managers in the survey welcome the idea, saying a ‘soft’ Brexit would improve their fundraising prospects. The rest are split between thinking it would have no impact either way (22 per cent) or that a softer Brexit would actually harm their fundraising capabilities (19 per cent).

Ian Kelly (pictured), Group CEO of Augentius, says: “For all the sound and fury on both sides of the Atlantic regarding the shock political developments of the last year and a half, global markets have remained relatively buoyant – and private equity and real estate is no exception. Our snapshot of sector sentiment reveals a picture of cautious optimism.

“Nonetheless despite the positives the picture is still a mixed one – a significant minority of managers across all regions are having a more troublesome year than planned for. Going forward, much will depend on how political and macroeconomic tensions end up playing out; managers will be keeping a keen on eye on the emerging details of the Brexit settlement in particular.”

European managers favour the UK and Channel Islands as domiciles

The results also pour cold water on the fear of a Brexit-driven exodus from the UK as a domicile – at least for the time being. When asked where they are likely to domicile their next fund, over half of European managers said the UK or the Channel Islands, with the UK leading the pack at 35 per cent. Luxembourg, the third most popular choice, was significantly lower at 14 per cent.

Cybersecurity and transparency

The research also provides insight into the extent to which the industry is adapting to new digital technologies, as well as how it is responding to demands from investors and regulators alike for more detailed information.

Among other factors, an ever-increasing cybersecurity risk is driving the industry away from the use of unsecured emails and PDFs towards the adoption of secure online investor portals. The research reveals this transition is very much still underway. The US is ahead of the curve, with almost half of managers now using investor portals. However a majority in Europe and Asia continue to use older, less secure methods, with Asia in particular lagging behind.

Ian Kelly, Group CEO of Augentius, says: “Although it’s good to see progress in this area, it’s clear that the road is still only half-travelled. Secure investor portals and similar innovations are the future of the industry and will become increasingly business-critical as cyber threats escalate. The appetite is there among investors – almost half of the LPs we spoke to expect to receive information in this way, yet only 35 per cent currently do so.

“It isn’t just about cybersecurity – investors want to be far closer to their investments than in the past. Around 35 per cent of the LPs we asked find themselves routinely requesting additional information, and worryingly around one-in-five never receive it. It’s a relatively easy way for managers to get ahead of the curve and position themselves strongly in an increasingly competitive and uncertain market.”

Trump and US interest rates

The US has also been suffering from political turbulence since its own shock election result. However this appears to be having little concrete effect on US managers’ ability to raise funds from investors, with only 16 per cent reporting problems in this area.

US managers are similarly relaxed about the prospect of a further rate rise, with 84 per cent saying they expect it to have negligible impact on deal flow.

Industry opinion regarding the proposed CHOICE Act – which would remove the need for PE and VC firms to register with the SEC – is sharply split along investor/GP lines. While 60 per cent of GPs surveyed see this as a positive step, the figure is reversed for the LP community who would prefer to see a regulated environment.

Delaware dominates as choice of domicile for US managers

The research revealed the sheer dominance of Delaware as a domicile choice, with over 70 per cent of US managers indicating that they plan to domicile their next fund there. A mere 7 per cent plan to domicile in the Cayman Islands, perhaps reflecting its diminished status as a domicile following the regulatory tightening of the past half-decade.

To see the full results of the survey, click here