CEPRES, a provider of investment decision analytics for private markets, has released research it recently conducted for the Institutional Limited Partners Association (ILPA) and presented at its Annual Members Conference.

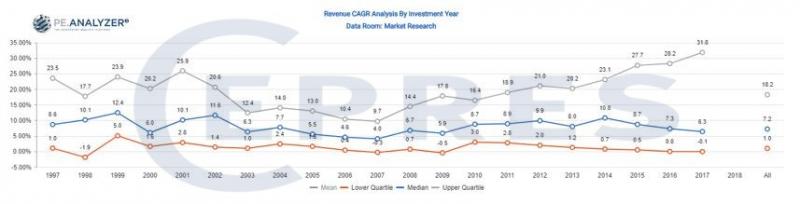

By analysing the outcomes of 58,000 companies invested by private equity and private debt funds, CEPRES showed that revenue growth is the biggest global driver of value creation and buyout investment returns even if other factors vary strongly across the regions. Further in the current market, only 25 per cent of portfolio-companies are significantly growing revenue and more than 50 per cent have decreasing revenue CAGR: so buying the market introduces inherent beta risk for investors (LPs). Fund managers (GPs) are maintaining discipline in the market and recovery rates are at all-time high even as defaults increase.

The full report is available to CEPRES members from: https://www.cepres.com/cepres-ilpa_mcon

“With market pricing and leverage at record levels, investors are rightly looking at fundamentals of the portfolio companies for their commitment decisions,” says Dr Daniel Schmidt, Founder & CEO CEPRES. “PE.Analyzer’s Market Analytics proves the private equity model has worked with returns primarily driven by top line growth of companies. The market is now driven by fewer very aggressively growing companies, especially in the high tech space, so GPs need to prove their ability to pick and foster the best growth companies, across all their companies to reduce cluster risks.”