CEPRES has released its latest analytics of the private markets landscape showing the increasing dominance of the largest private equity firms on their PE.Analyzer investment network.

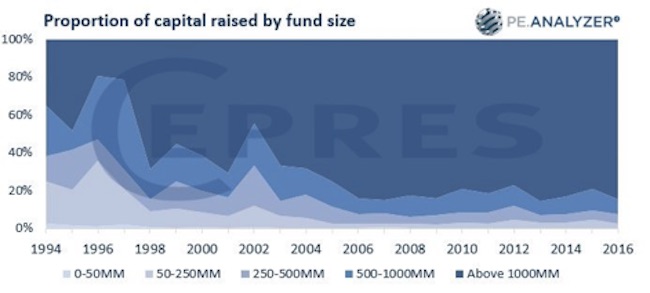

Of 5,195 funds active on the platform, 80 per cent of the capital is now being raised by only 20 per cent of larger GPs compared with a 50/50 ratio 15 years ago. Large fundraisings are dominated by North American buyouts, venture still attracts smaller funds, especially in Asian and undeveloped markets. Emerging managers (1st and 2nd time funds) have been squeezed in recent years and need to use all the tools in their arsenal to compete.

Fortunately the CEPRES analysis shows that on average 1st and 2nd time funds outperform mature managers, so new and spinout GPs can compete on a level playing field with the right evidence.

Highlights:

• Analysis of 5,195 funds, 59,126 companies and $20.6 trillion of private investments

• North America Buyouts dominate the fundraising landscape

• Asia and emerging markets offer more diverse fund sizes than western markets

• Venture is still most active with small to medium funds

• Larger funds currently offer the strongest median returns, but smaller funds provide more upside

• Private market risk as measured by deal default rates is low, but starting to trend upwards

The full report is available to CEPRES members from: https://www.cepres.com/latest-intelligence

“The activity on the PE.Analyzer network confirms the dominance of larger brand name funds in the fundraising landscape,” says Chris Godfrey, President CEPRES Corp. “The good news for emerging managers is we see the upside that can be generated by 1st and 2nd time funds, so institutional investors waiting for managers to mature may be missing some portfolio alpha. We have seen that as private equity allocations have increased, the market has matured and risk is better managed. Conversely some of the market fundamentals like leverage, pricing and revenue growth are weaker and warrant consideration for current investment decisions.”