CEPRES has released its latest investment analysis based on transactional private markets data of 72,772 investments across 7,189 funds valued at USD26.5 trillion.

The analysis shows that Technology driven investments by Buyout, Growth and Venture funds have delivered substantial returns over the last decade. Overall Tech deals have achieved 29 per cent gross pooled internal rate of return (IRR) based on a transaction level analysis of the CEPRES Analysis platform.

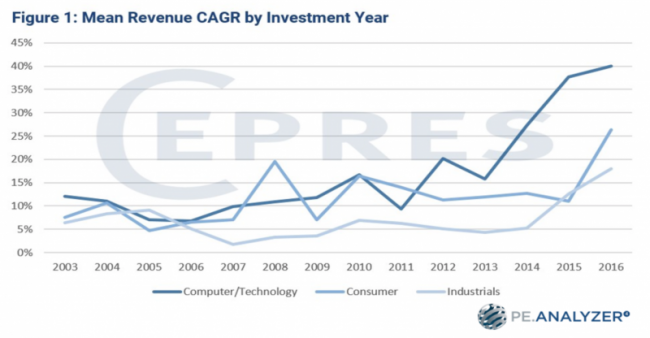

Comparing the average Compound Annual Growth Rate (CAGR) of Revenue in PE across different industries, we can observe a clear outperformance of the technology deals against other industries. Taking Industrials as a comparison, PE-backed technology firms outperformed industrials in general, and the outperformance has been getting stronger since 2007 – the spread widened from 8 per cent in 2007 to 22 per cent in 2016:

Source: CEPRES PE.Analyzer Copyright © 2019 CEPRES GmbH

The full analysis is available to CEPRES members from: https://www.cepres.com/latest-intelligence-for-lps

“The pricing of Tech deals is vindicated by this analysis of private company growth and returns. With current market volatility and renewed concerns over pricing and leverage, it is critical investors focus on such fundamentals,” says Christopher Godfrey, President CEPRES Corp. “This type of analysis provides the empirical evidence to back up deeper investment theses. Through the transactional engagements we have with LPs, GPs and Consultants, we are uniquely positioned to uncover key investment drivers that underwrite investment strategies or single investments.”