Latest News

London-based Hoxton Ventures has led a USD10 million funding round in online learning platform Preply, with participation from European investors Point Nine Capital, All Iron Ventures, The Family, EduCapital, and Diligent Capital.

The capital raised in this round, which doubled the total raised previously, will be used to grow the Preply network of 10,000 verified tutors teaching 50 languages to tens of thousands of students in 190 countries worldwide, according to the company.

Using the new funding, the company plans to scale the marketplace, mainly in North America, France, Germany, Spain, Italy and the UK.

In addition, the company aims

- 03/04/2020

Draper Goren Holm, a Los Angeles based venture firm led by Tim Draper, Alon Goren, and Josef Holm, has appointed Rodney Sampson as the team’s newest Venture Partner.Previously in his career, Sampson successfully co-founded, built and sold Multicast Media Technologies (Streamingfaith.com) for USD24 million in 2010, and was a previous partner and remains the largest minority LP at TechSquare Labs whose investments are valued at well over USD1.5 billion. Today, he is a Nonresident Senior Fellow at The Brookings Institution and Executive Chairman of OHUB, the leading inclusive ecosystem building platform to ensure that everyone, everywhere is equitably represented in

- 03/04/2020

Venture capital investment firm TrueBridge Capital Partners has held the close of its second direct investment fund, TrueBridge Direct Fund II, with USD190 million in commitments, exceeding its fundraising target. TrueBridge has successfully closed seven funds to date, including its flagship funds-of-funds and inaugural direct fund, bringing the firm’s total assets under management to USD3.3 billion.

The fund received strong demand from investors worldwide and was oversubscribed, with commitments from both new and existing investors. The diverse array of investors includes foundations, endowments, pension plans, family offices, and high net worth individuals.

The new fund will target top-performing venture and growth

- 03/04/2020

Aksia has completed the acquisition of TorreyCove Capital Partners. In January, the firms announced that they had entered into an agreement and expected the transaction to close in the first half of 2020. Financial terms have not been disclosed.With the integration, the combined firm now advises on over USD160 billion in alternative assets with more than 250 professionals globally, including over 160 professionals focused on investment research, operational due diligence, risk management and client operations. As a specialist alternatives research and investment advisory firm serving the needs of institutional investors, Aksia’s expertise now covers private equity, private credit, hedge funds

- 02/04/2020

Private equity (PE) secondaries are increasingly being harnessed by sellers in Europe as an attractive option for actively managing exposure to PE and its various sub-sectors, according to Cerulli.For buyers—particularly investors new to PE—secondaries can be a highly efficient way to quickly create diversified exposure to different vintages, strategies, and managers, says research from Cerulli Associates.

One of the clear attractions of the secondary market, notes Justina Deveikyte, associate director, European institutional research at Cerulli, is that a buyer on both sides of the market might commit to a new fund and also purchase a limited partner position via a

- 02/04/2020

Harbert European Growth Capital Fund II (HEGC) has funded UKCloud Limited (UKCloud) with debt capital. UKCloud’s platform supports hundreds of public services across government, healthcare and the wider public sector, many of which underpin critical services used by citizens, businesses and public sector workers (such as health professionals) nationwide. The debt will be used to help UKCloud continue on its expansion of its multi-cloud platforms and provide cash runway for organic growth.

UKCloud is an early pioneer of digital transformation within UK public sector where the market opportunity in this segment alone is north of £2 billion. UKCloud specialises in the

- 02/04/2020

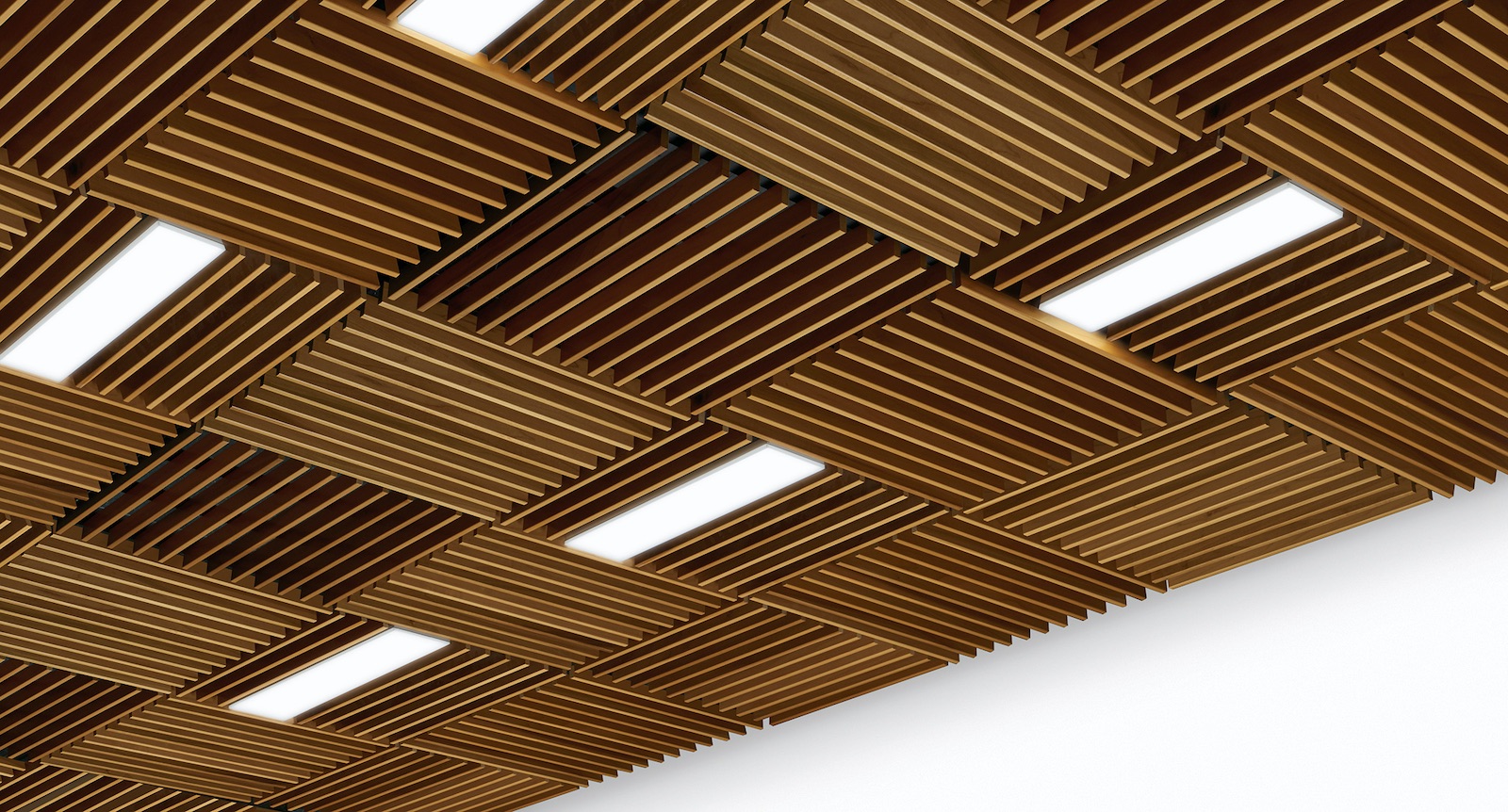

Aurelius Equity Opportunities has finalised its acquisition of Armstrong Ceiling Solutions, the Armstrong ceiling tiles and grids businesses, from Knauf International.

- 02/04/2020

The Blackfinch Spring VCT has raised over GBP3.3 million to invest in a portfolio of technology and tech-enabled companies, since its launch in December.

- 02/04/2020

SoftIron Ltd, a London-based developer of energy-efficient Ceph storage hardware and software for data centres, has secured USD34 million in new capital. The funding, led by company chairman Norman Fraser, supported by Earth Capital, the global investment firm, and various existing investors, will be deployed to expand its presence across North America, Europe and the APAC region. SoftIron will also use the injection of new capital to strengthen engineering initiatives to further build out its portfolio of data centre appliances based on open-source software.

Using open-source Ceph software, SoftIron makes task-specific appliances for scale-out data centre solutions, delivering industry-leading performance

- 02/04/2020

CEPRES, a provider of portfolio forecasting for Private Markets, is advising clients to use 10 per cent VaR (Value at Risk) forecasts for 2020 and 2021 due to the COVID-19 outbreak. CEPRES projects outcomes for more than 100 Institutional investor portfolios around the world including pensions, insurers and endowments based on their “PE.Forecast” software. The technology runs 100,000s systematic and idiosyncratic Monte Carlo based scenarios to build distributions for future portfolio liquidity, NAV and returns.

By studying previous crash scenarios and comparing to the impact of the current crisis, CEPRES experts are now applying a 10 per cent VaR liquidity forecast

- 02/04/2020

Special Reports

Featured

- Intel

- May 3, 2024

- Intel

- May 2, 2024

- Intel

- May 1, 2024

- Intel

- April 30, 2024

- Intel

- April 29, 2024

- Intel

- April 26, 2024

Events

16 May, 2024 – 8:30 am

16 May, 2024 – 5:30 pm

05 June, 2024 – 8:30 am

12 September, 2024 – 8:30 am