Following massive deployment of private capital and recent volatile markets, CEPRES reports up to an 80 per cent increase in risk and fundamental analysis on its Investment Decision Platform – PE.Analyzer.

CEPRES has seen a huge 60 per cent growth in investment transactions during 2018 to USD23 trillion of assets across 63,973 private market deals from 6,032 Funds. With now the largest-ever transactional data on private markets, CEPRES clients can measure and stress test their investments versus macro-economic conditions to ensure they can protect against volatile market conditions.

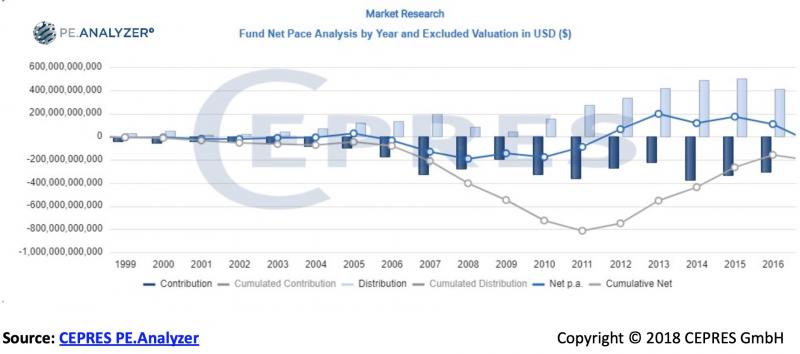

There has been a strong recovery in private markets following the Global Financial Crisis. By harvesting the premium pricing in global markets, fund managers (GPs) distributed increasing cash to Investors (LPs) since 2009. Especially since 2011, when the cumulative net contributions reached historic highs, LPs gained more money in distributions than they contributed every year since. As a result, confidence in the private markets boosted, attracting more money constantly since 2013 – also driven by the rapidly increasing returns.

With recent market volatility, investors are showing concern by paying increasing attention to risk and operating company fundamentals as demonstrated by CEPRES activity. Reviewing analytics of 2,000 LPs, GPs and Advisory firms on their PE.Analyzer platform, CEPRES saw an 82 per cent increase in analysis of risk factors such as loss rates, volatility and variance and a 58 per cent increase in analysis of operating company fundamentals such as leverage, pricing and EBITDA growth. In the past this type of deep technical and fundamental analysis was very hard to achieve in private markets, but CEPRES has developed innovative technology and services changing the way the industry operates.

“There is a lot of concern about overheating capital markets, including private equity,” says Christopher Godfrey, President CEPRES Corp. “Whilst it is true the levels of capital inflow should give investors pause for thought, the illiquid nature of private markets inherently provides protection in volatile market conditions. We recommend investors to be defensive and evaluate underlying investment risk and fundamentals in their current portfolio and when underwriting new commitments. In highly levered and priced markets as we see today, revenue growth and credit discipline are two important factors to measure for your investments. We are pleased that CEPRES can help shine a light on these topics and assist private market professionals to achieve stronger outcomes in all market conditions.”