This extract from the Preqin Quarterly Update: Real Estate, Q3 2015 examines current closed-end private real estate funds in market, looking at target capital, primary geographic focus, time spent on the road and a sample of the largest funds currently fundraising.

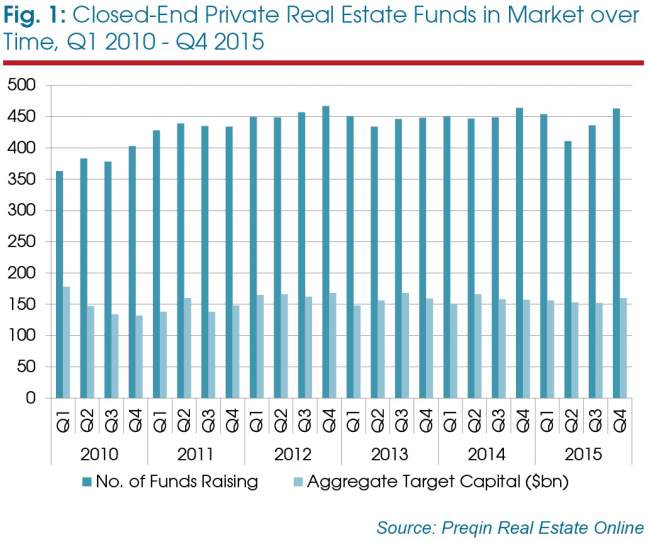

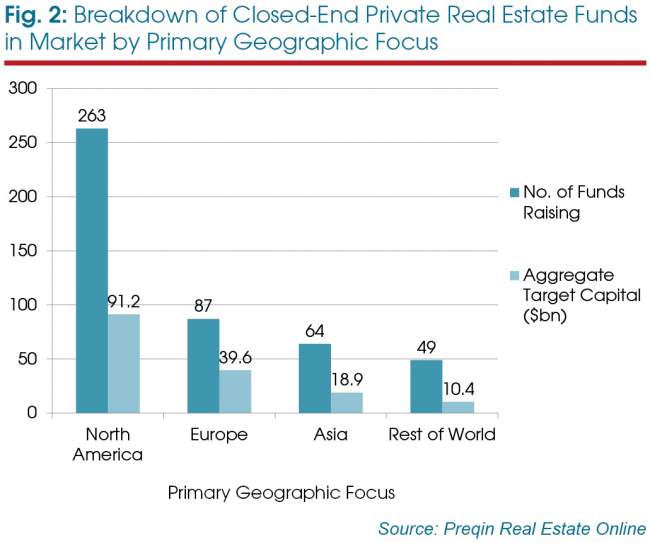

The number of closed-end private real estate funds in market has increased slightly since Q2, with 463 vehicles currently seeking USD160 billion in capital (Fig 1). The make-up of funds in market at the start of Q4 2015 remains relatively consistent, with the majority of funds in market and aggregate target capital focused primarily on North America (Fig 2).

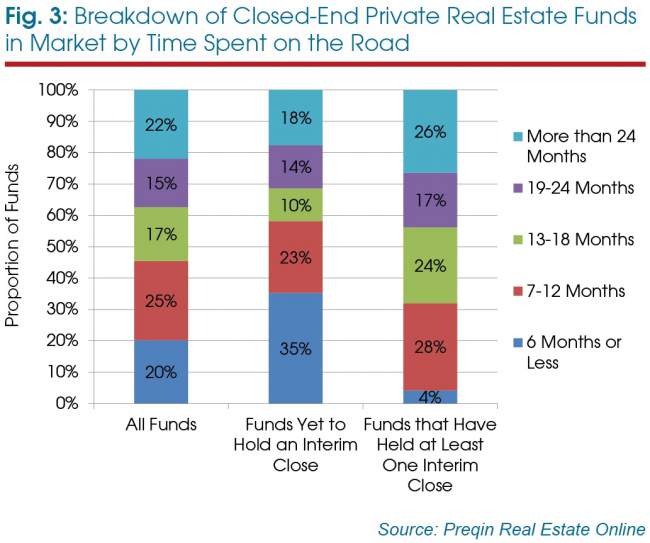

The fundraising market remains competitive: 55% of funds on the road have been raising capital for over a year. Fifty-eight percent of funds that have yet to hold an interim close have been launched in the last 12 months, while 68% of vehicles that have held at least one interim close have been in the market for over a year.

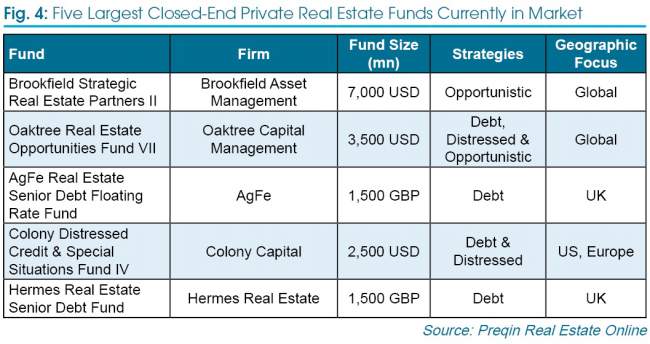

The largest closed-end private real estate fund in market is Brookfield Strategic Real Estate Partners II, currently targeting USD7 billion in institutional capital commitments. Managed by Brookfield Asset Management, the fund will look to invest in commercial properties and real estate operating companies on a global scale (Fig 4). If Brookfield Strategic Real Estate Partners II reaches its target capital in its final close, it will become the ninth largest closed-end private real estate fund of all time.

This article is an extract from the Preqin Quarterly Update: Real Estate, Q3 2015, one of five quarterly editions that also cover private equity, hedge funds, infrastructure and private debt. Download all of the reports for free by visiting our website.