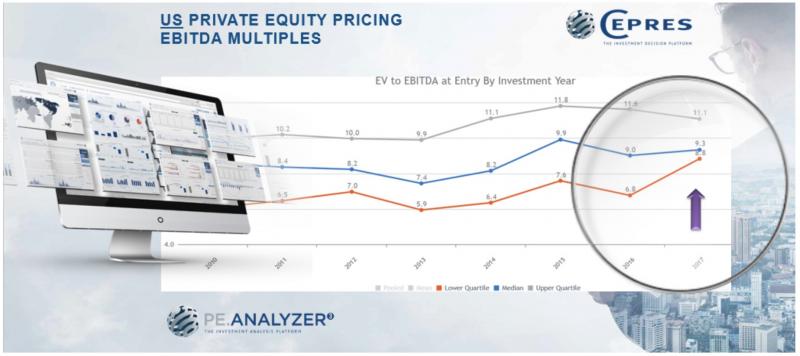

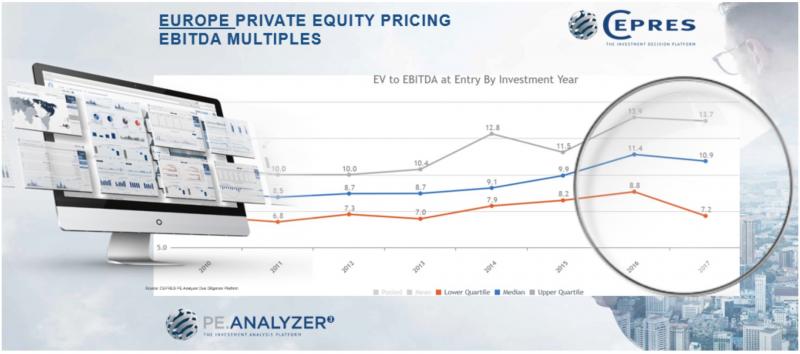

New research released by CEPRES shows how the growth in so-called ‘dry powder’ is driving up EBITDA pricing multiples for US and European Buyouts. ‘Dry powder’ is a measure of how much capital remains committed by investors, but un-deployed in the market.

Following multiple years of increased fundraising, especially in the US, the amount of capital available to invest in buyouts and venture capital is at unprecedented levels.

The research was based on CEPRES award winning PE.Analyzer analytical platform. Now in its 4th generation it encompasses analysis of USD16 trillion of PE-backed companies across 4,199 private capital funds. The analysis shows whilst US deals in the top quartile remain at steady but high pricing, pricing in the lower quartile has increased significantly in the last year and is converging with the market median as more money chases fewer deals in the market. In Europe where growth is not as positive as the US, the lower quartile of the market has softened, but the median and upper quartile deals remain highly priced. This is also fuelled by a shift in asset allocations from LP investors who recognise the US has stronger medium-term growth potential than Europe.

The full report and analysis can be downloaded from: https://www.cepres.com/impact-dry-powder-private-equity-markets

“For Buyouts, EBITDA multiples are at their highest levels for over a decade and in the US we see a convergence of pricing in the lower half of the market,” says Dr Daniel Scmidt (pictured), Founder nad CEO of CEPRES. “This could be a concern for investors who worry that IRR returns have reached their peak and may experience downward pressure in future years. With deals being priced so highly, investors are focused on higher growth markets because value creation will need to be driven by growth prospects rather than market pricing going forward. Thus we see investors starting to shift their asset allocation to the US which has stronger growth potential than Europe currently.

“As always, we recommend investors to understand the true drivers of risk and returns of the markets they invest in and the GPs they commit to. Measuring and benchmarking fundamentals like deal pricing as well as risk adjusted alpha and beta correlation are critical for investors at this time.”