New research from CEPRES shows how first-time private equity funds (ie first generation funds aka “Emerging Managers”) outperform later generation funds on a risk adjusted basis. By comparing the returns and loss rates of buyout deals invested by different generations of funds, CEPRES was able to see clear patterns of behavior linked to the maturity of the Manager.

The research was conducted on CEPRES’ award winning PE.Analyzer4.0 platform encompassing detailed performance of USD17.5 trillion of PE-backed companies across 4,888 private capital funds. The analysis shows whilst second generation funds deliver the strongest gross IRR returns in their deals, it is at the cost of increased risk exhibited through higher loss rates and lower recovery rates. Later generation funds show lower gross deal returns and moderate loss rates. First generation funds stand out as having the best risk adjusted returns, with deal returns exceeding later generation and the lowest loss rates combined with significantly higher recovery rates on their deals.

For more about research from CEPRES visit https://www.cepres.com/private-equity-database

Highlights

- Analysis from CEPRES research encompassing 4,888 private market funds and 52,191 deals

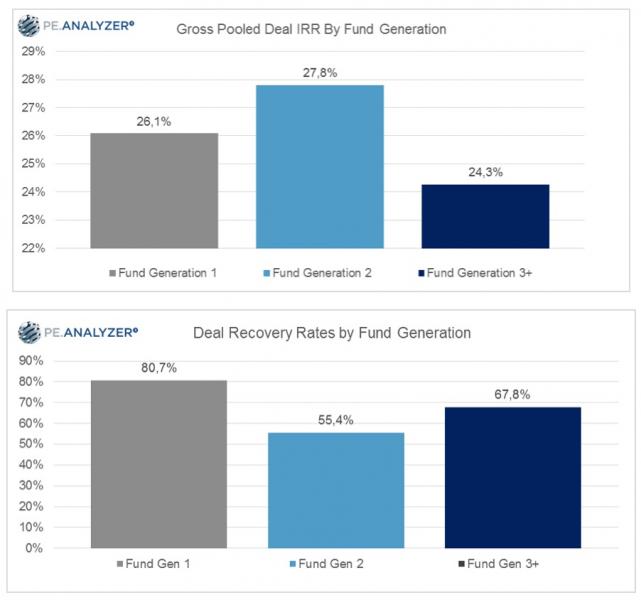

- First generation funds have medium Gross Deal IRR of 26.1%, but lowest Deal Loss Rate of 5.1% and highest Recovery Rate of 80.7%

- Second generation funds have highest Gross Deal IRR of 27.8%, but highest Deal Loss Rate of 7.7% and lowest Recovery Rate of 55.4%

- Later generation funds have lowest Gross Deal IRR of 24.3%, but medium Deal Loss Rate of 6.2% and middle Recovery Rate of 67.8%

Christopher Godfrey, President CEPRES Corp, says: “There is always intense speculation about how emerging managers perform vs more mature ones and we now have empirical evidence to look under the covers and see. From these results, it is clear that first time managers are the most disciplined when it comes to protecting downside risk on their investments. The Recovery Rates for these funds are outstanding whilst at the same time making better returns than mature managers. The second generation funds are interesting to see how they are more aggressive with higher returns combined with higher risk in their deals. Finally by the third generation and beyond, managers appear to have settled into a balance between risk and returns but don’t quite reach the original results on either of their first fund.

“As always, we recommend investors to make their own analysis and due diligence of each manager they consider. Measuring and benchmarking Deal Loss & Recovery rates alongside IRR returns can provide great insights into their capability, especially in rich markets as we have today.”