This extract from the Preqin Investor Outlook: Alternative Assets, H2 2015 features data gathered in our latest investor interviews (conducted June 2015) and focuses on hedge fund investors’ plans for the coming year.

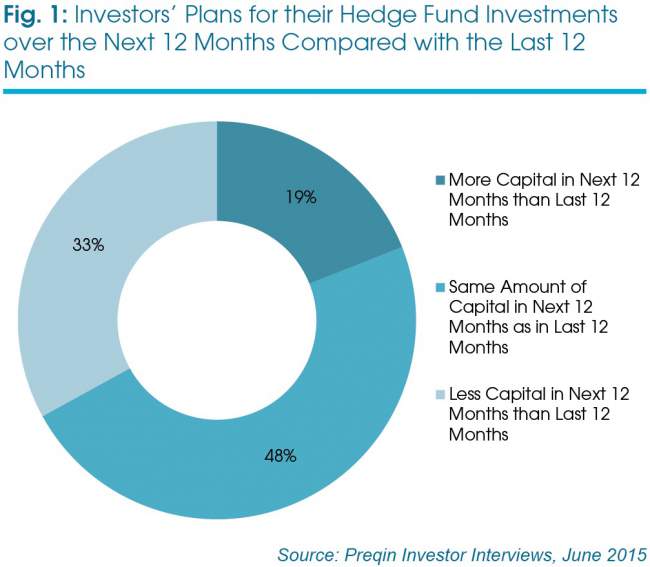

A larger proportion of investors plan to invest less capital in hedge funds over the next year than are planning to invest more capital in the asset class (Fig 1). The failure of hedge funds to meet investors’ expectations, in terms of performance, over the past 12 months may have contributed to the reluctance of many investors to put more money to work in the asset class in the year to come, as they put portfolios on ice or re-evaluate the weighting of hedge funds in their portfolios.

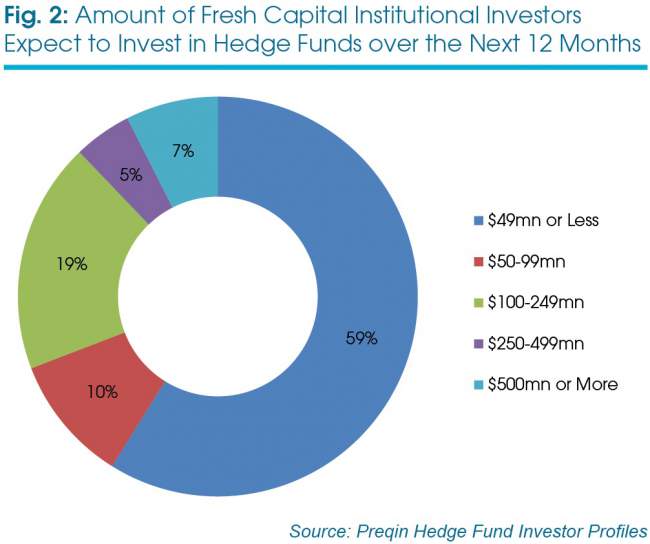

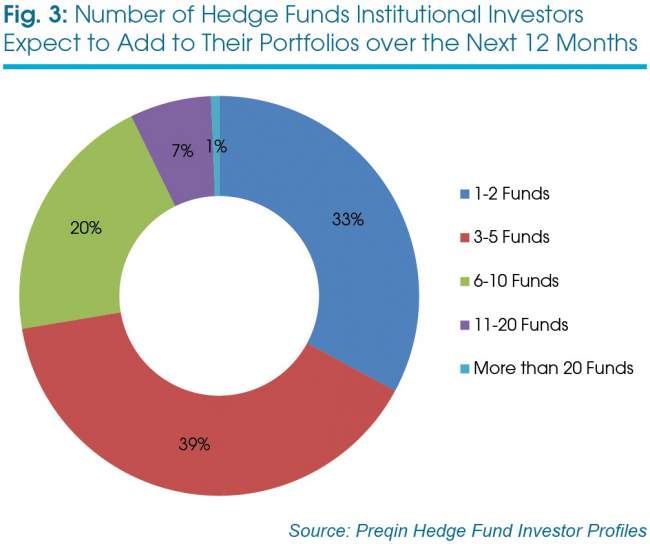

Of those investors that are actively looking to make new investments in the year ahead, the majority (59 per cent) will be seeking to make investments of USD49 million or less, whereas just 12 per cent of these investors are planning to put USD250 million or more to work in the asset class in the next 12 months (Fig 2). However, while most investors will be deploying relatively small amounts of capital in hedge funds, this will be distributed across multiple funds. Two-thirds of the active institutional investors on Preqin’s Hedge Fund Investor Profiles service are planning to invest in at least three funds in the next 12 months (Fig 3).

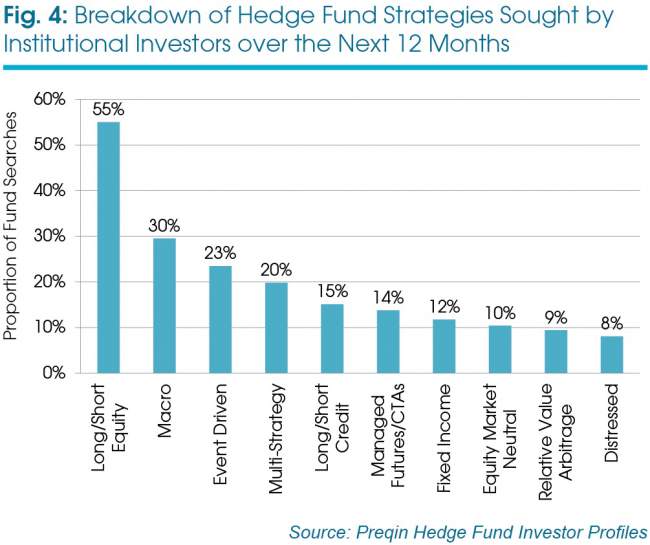

Long/short equity and macro funds are the most commonly sought-after strategies by those investors looking to make new investments; 55 per cent and 30 per cent of current fund searches respectively include these strategies as a preference (Fig 4). At the other end of the liquidity spectrum, event driven funds, with their longer investment horizons and potential for return premiums, are also commonly sought by institutional investors. Twenty-three percent of investors currently searching for new funds in the year to come include event driven funds as part of their search, potentially for the strategy’s ability to generate higher returns over the longer term, something that many investors have found hedge funds have not managed to do in the past year.

This is an extract from the Preqin Investor Outlook: Alternative Assets, H2 2015, click here to download the full report for free.