Hedge fund launches are under the spotlight in this extract from the Preqin Quarterly Update: Hedge Funds, Q3 2015.

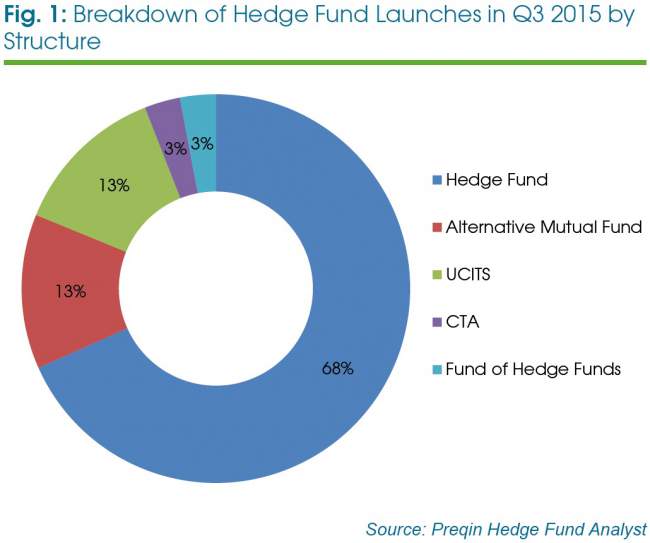

Alternative mutual funds saw a significant rise in their share of new fund launches in Q3 2015. These structures accounted for 13 per cent of the new launches monitored by Preqin’s Hedge Fund Analyst, a 10 percentage point increase on the previous quarter (Fig 1). Their European equivalent, UCITS vehicles, also accounted for 13 per cent of fund launches in Q3 2015, an increase from 9 per cent in Q2 2015. Single-manager hedge funds maintained their dominance: these funds accounted for over two-thirds of all launches in Q3 2015.

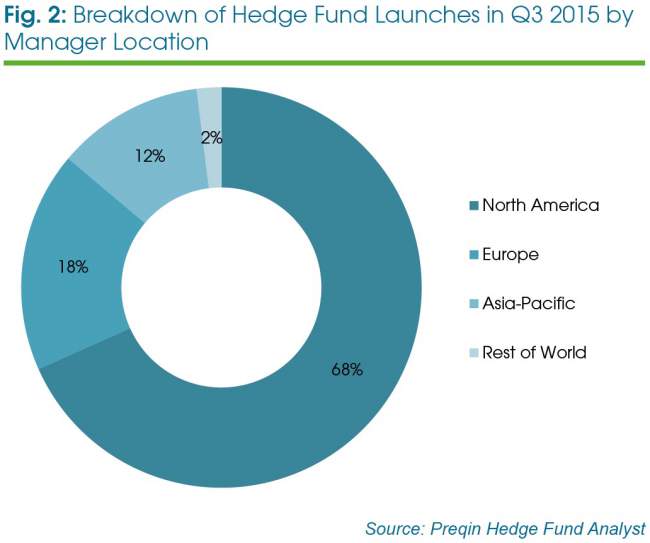

The composition of launches based on manager location remains largely unchanged from the previous quarter. Managers based in Europe fell to representing 18 per cent of launches in Q3 2015, from 22 per cent the previous quarter (Fig 2). North America-based managers comprised 68 per cent of all launches, an increase of one percentage point. The proportion of managers based in Asia-Pacific and Rest of World rose by three percentage points to collectively represent 14 per cent of launches.

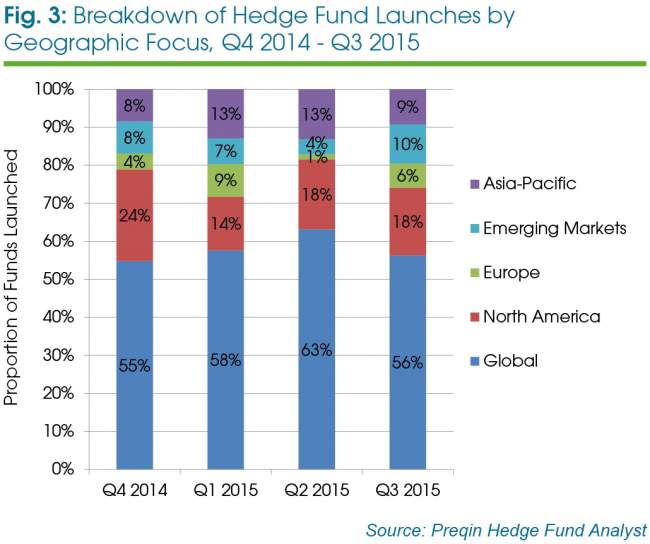

Launches of funds investing globally saw a gradual increase over the three quarters between Q4 2014 and Q2 2015; however, in Q3 2015 this trend reversed, with these vehicles accounting for 56 per cent of fund launches (from 63 per cent in Q2 2015), as shown in Fig 3. Funds with a European geographic focus increased from representing 1 per cent of launches in Q2 2015 to 6 per cent in Q3 2015. North America-focused vehicles accounted for 18 per cent of all launches in Q3 2015.

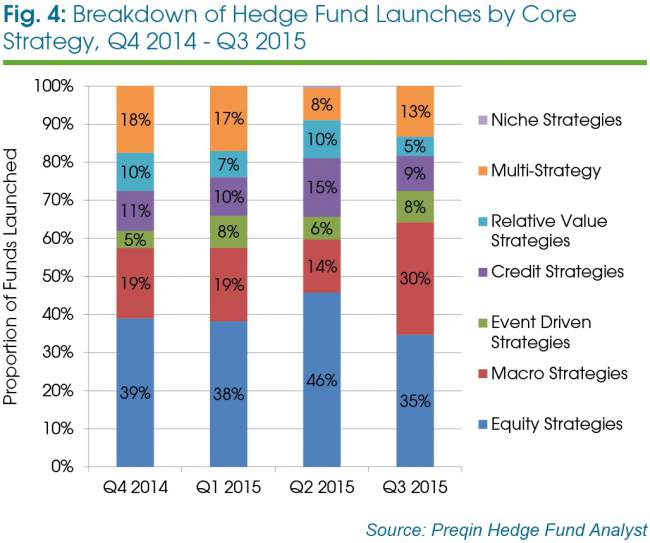

Macro and equity strategies represented a combined share of 65 per cent of fund launches in Q3 2015 (Fig 4). In fact, macro strategies vehicles saw their share rise from 14 per cent in Q2 2015 to 30 per cent in Q3 2015, the largest proportion of macro strategies launched since Q3 2013 when they accounted for 29 per cent. In contrast, equity strategies fund launches fell by 11 percentage points to 35 per cent of all launches in Q3 2015.

This article is an extract from the Preqin Quarterly Update: Hedge Funds, Q3 2015, one of five quarterly editions that also cover private equity, real estate, infrastructure and private debt. Download all of the reports for free by visiting our website.