Stephen Yates examines Preqin’s latest data on wind power deals, including aggregate deal value, average deal size and the most prominent regions for wind power deal activity.

Preqin’s Infrastructure Deals module on Infrastructure Online includes extensive information on over 11,200 completed transactions in infrastructure assets globally. These deals encompass a wide variety of investors, ranging from infrastructure fund managers and direct institutional investors to developers, contractors and other industry-specific trade investors. Over 8,100 infrastructure transactions have been completed since 2006, worth an estimated deal value of approximately USD1.8 trillion. Renewable energy is a prominent sector within the asset class, with wind power deals alone accounting for 17 per cent of all transactions completed since 2006.

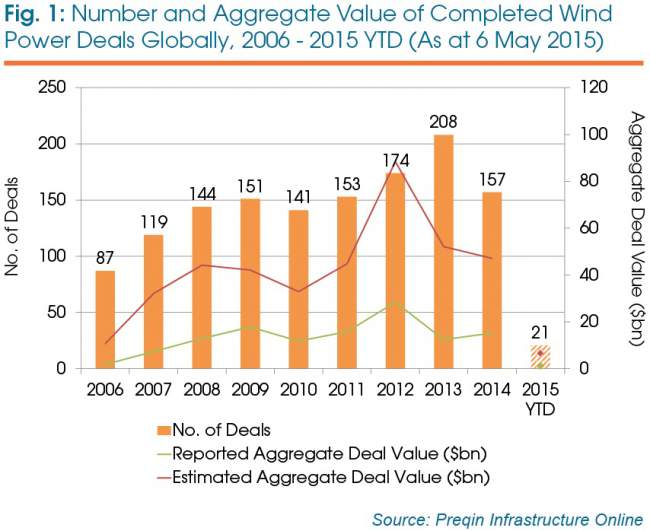

As shown in Fig 1, the annual number and estimated aggregate value of deals completed within the wind power space increased significantly from 2006 to 2012. 2012 saw wind power-based deal transactions reach an all-time high in terms of estimated aggregate deal value, with 174 transactions achieving an estimated aggregate value of USD88.4 billion, representing a 726 per cent increase in six years. 2013 witnessed the largest number of completed transactions in a calendar year (208); however, there was a drop in estimated aggregate deal value of USD36.3 billion.

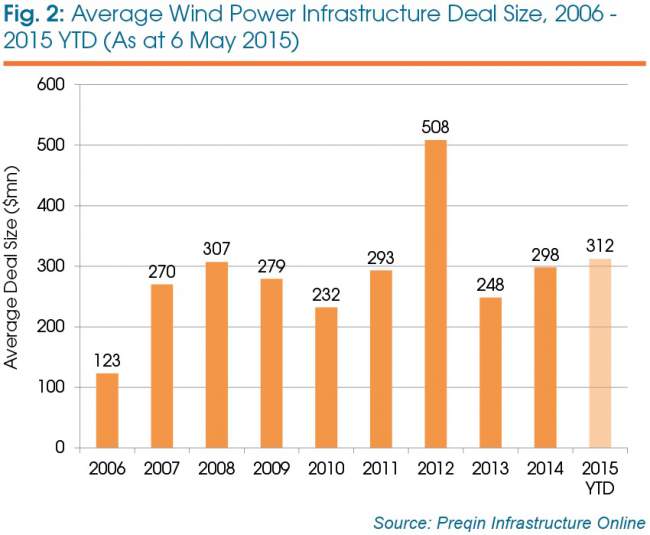

Deals have typically averaged around the USD300 million mark each year (Fig 2), with the exception of 2012 when there were a number of large deals occurring in the USD100-499 million and USD1 billion and over value bands.

There has been a substantial increase in the development of wind farms owing to a growing global demand for alternative sources of energy, and so it is not surprising to see that 64 per cent of the wind power assets involved in deals between 2006 and 2015 YTD were at the greenfield stage of development when the deal was struck.

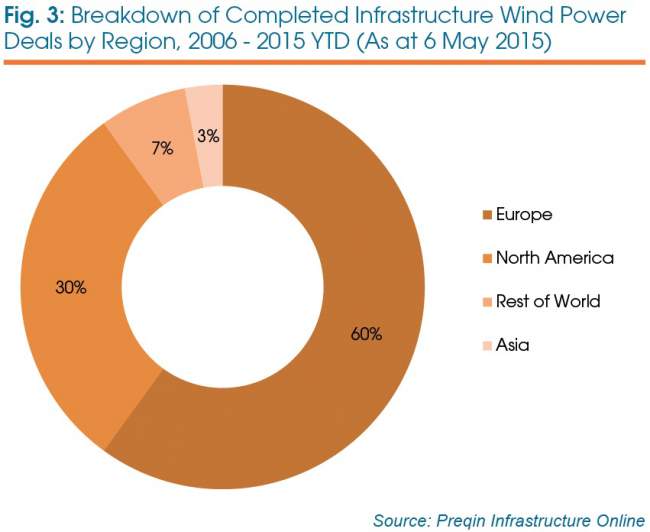

Historically, Europe is the most prominent market in terms of infrastructure deal flow, with the region home to the majority (60 per cent) of wind power-specific transactions completed in 2006-2015 YTD (Fig 3). The most prominent country for infrastructure investment in Europe was the UK, which represented 31 per cent of all wind power transactions on the continent, followed by Germany (19 per cent), France (15 per cent), Spain (7 per cent) and Italy (5 per cent).

Several notable deals took place in 2014 and early 2015. In the UK, E.ON acquired a 100 per cent stake in Rampion Offshore Wind Farm, a portfolio of 175 wind turbines located off the coast in Sussex, in a deal worth GBP2 billion. Other notable deals include the acquisition of Kipeto Wind Farm, a 100 MW wind farm in the Maasai land, Kenya, by a consortium of investors including African Infrastructure Investment Managers and International Finance Corporation (IFC), in a deal worth USD316 million.

This is an extract from the Preqin Infrastructure Spotlight: May 2015, read the full report for free, also covering sovereign wealth funds investing in infrastructure, US- and Canada-based pension funds and more.