This extract from the Preqin Investor Outlook: Alternative Assets, H2 2015 analyses the responses gathered in Preqin’s latest round of investor interviews to find out what investors in private equity believe are the biggest issues they face at present.

Preqin’s recent survey exposed valuations, deal flow and fee pressure as some of the biggest challenges investors face while seeking to operate an effective private equity portfolio. While regulation has been cited as a key issue by over a third of LPs surveyed, it seems a large proportion of investors are yet to adjust their private equity investment plans in light of recent regulatory changes.

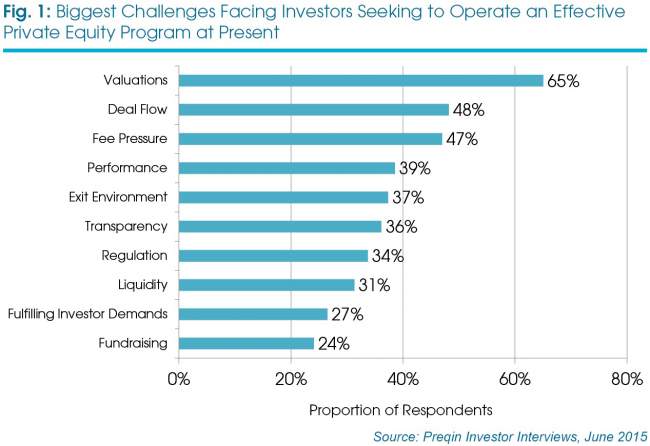

Fig 1 shows the range of challenges private equity investors grapple with in today’s market. Valuations have come under much scrutiny from investors, ranking as the top concern of the private equity investor community in H2 2015. There have been concerns about the surge in global liquidity and low interest rates driving up asset valuations, which in turn could negatively affect returns. Deal flow, the exit environment and performance are also factors that have emerged as significant challenges perceived by LPs.

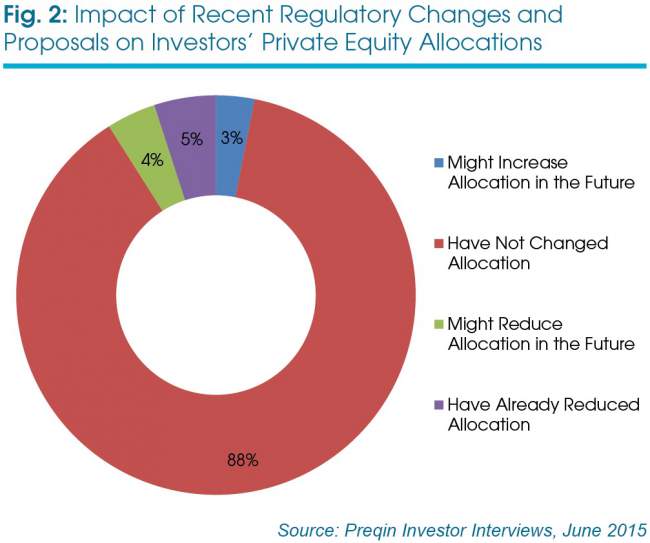

The proportion of investors that have indicated regulation is a key issue has grown from 21 per cent in June 2014 to 34 per cent in June 2015. However, with several delays and much uncertainty surrounding the implementation of various reforms including the AIFMD, Solvency II, Dodd Frank and Basel III in recent years, the impact on private equity allocations is yet to be seen. While these regulations place restrictions on particular investor types, only 5 per cent of LPs surveyed have had to reduce their allocations to private equity as a result, with only 4 per cent contemplating a possible reduction in their allocation in the future (Fig 2).

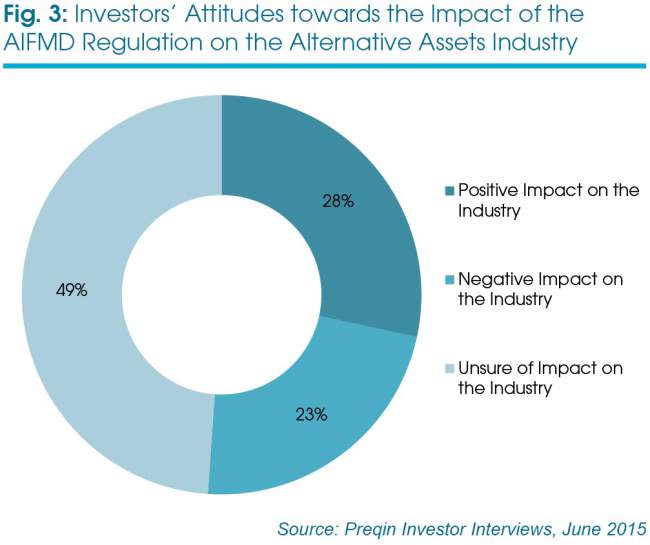

As of June 2015, just under half of institutional investors (49 per cent) are unsure as to whether the European AIFMD regulation is beneficial for the private equity industry, compared with 23 per cent that believe it is detrimental to the industry (Fig 3). Reasons for the perceived negative impact include the belief that it is an unnecessary protection for investors and that it will lead to reduced choice.

This is an extract from the Preqin Investor Outlook: Alternative Assets, H2 2015, click here to download the full report for free.