By Anthony Werley (pictured), Chief Portfolio Strategist, Endowment and Foundations Group, JP Morgan Asset Management – We recently published our Long Term Capital Market Assumptions for 2015. These are our central case expectations for asset class returns, volatilities and correlations over the next 10—15 years, and they are meant to be cycle-neutral. In other words, our return assumptions are independent of the current stage in the business cycle, and are built to reflect long-term market trends.

Our analysis confirms the view that private equity is set to face both tailwind and headwind non-market factors. On the negative side of the outlook, the size of cash assets needing to be put to work and stretched valuations are likely to represent the key concerns. The valuation environment, as of mid 2014, was described by one financial sponsor executive as “daunting.”

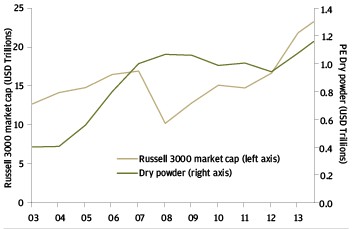

Stretched valuations for financial sponsors also mean stretched valuations for public market investors. As such, the private equity mark-up vs the public market return expected by investors is not necessarily affected. Exhibit 6 and Exhibit 7 put the “dry powder” and valuation issues in perspective. Exhibit 8 examines the current EV/Ebitda valuation (enterprise value to earnings before interest, tax, depreciation and amortisation). In the first quarter of 2014, EV/Ebitda was 9.1. The last time valuations were at this level was during 2008.

However in our experience the average financial sponsor adds a negligible return premium compared to the public markets which is inadequate compensation for the additional risks taken by investors. In this part of the investment spectrum, the focus must be on the dispersion of return rather than inherent return potential of the private equity investment model. Considering the additional leverage, fees and illiquidity of the strategy class realising some portion of the alpha potential is a necessity for rationalising a private equity allocation.

Source: JP Morgan Asset Management, Preqin; data as of 23 July 2014

Source: JP Morgan Asset Management, Preqin; data as of 23 July 2014

Source: S&P Capital IQ LCD; annual data from 2000 to first quarter 2014

The private equity opportunity set, particularly for the large and/or skilful operator, has expanded over the past few years, partially addressing the issue over the scalability of the private equity model. An example of the evolving opportunity set over the past few years has been the sale of private equity partnerships into the secondary market. While this niche strategy has produced returns above average, the strategy is likely to have passed the sweet spot of its return profile.