This extract from the Preqin Quarterly Update: Real Estate, Q2 2015 focuses on institutional investors in private real estate and their plans for the next 12 months regarding strategy, regional preferences and the size and number of planned capital commitments.

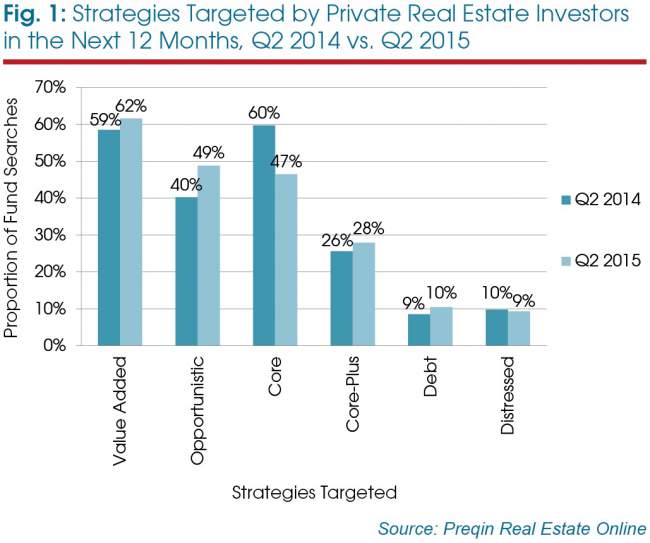

The majority of investors seeking new commitments will target value added funds over the next 12 months (62 per cent), with the proportion targeting opportunistic vehicles increasing by nine percentage points (Fig 1). Demand for core vehicles has dropped by 13 percentage points, which could convey investors’ willingness to take on more risk in the search for higher returns.

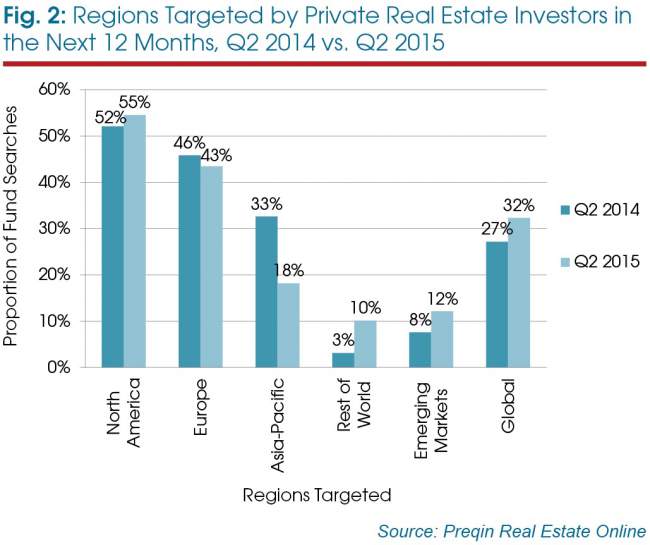

North America remains the favoured region for investment in the year ahead (Fig 2). Interest in emerging markets and other regions outside the traditional geographies has increased at the expense of Asia-Pacific: the region exhibited a decline in investor interest of 45 per cent from last year.

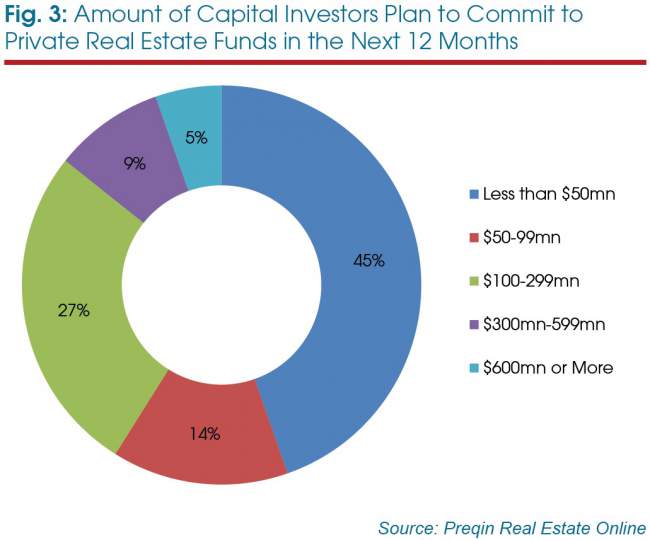

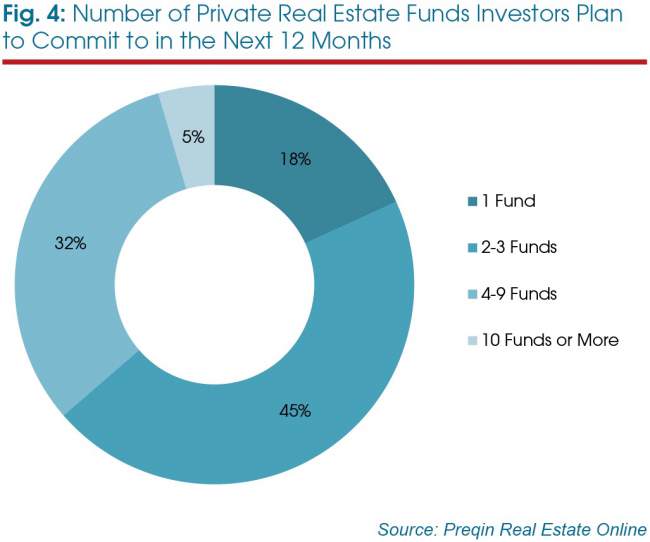

In terms of the amount of capital investors plan to commit to real estate in the next 12 months, Fig 3 reveals that 45 per cent of institutions intend to commit less than $50mn; however, there are also institutions that are looking to invest large amounts of capital: 14 per cent of investors are planning to commit $300mn or more. There are encouraging signs for fund managers currently marketing funds: 37 per cent of investors are planning to make four or more new fund commitments in the coming year (Fig 4).

Preqin releases quarterly reports covering private equity, hedge funds, infrastructure, real estate and private debt. All five quarterly updates can be accessed for free in our Research Center.